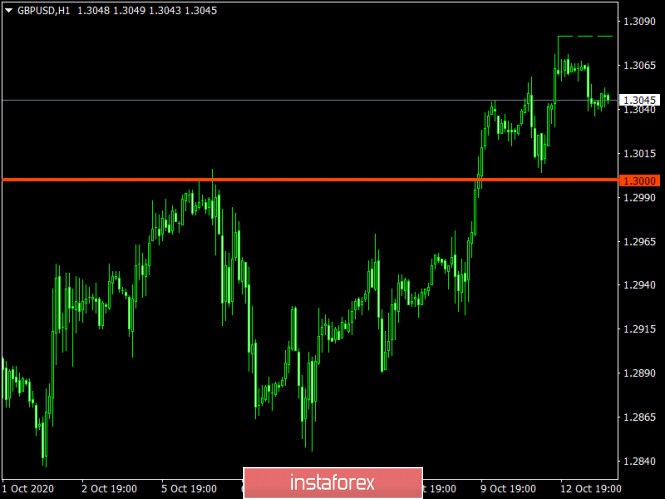

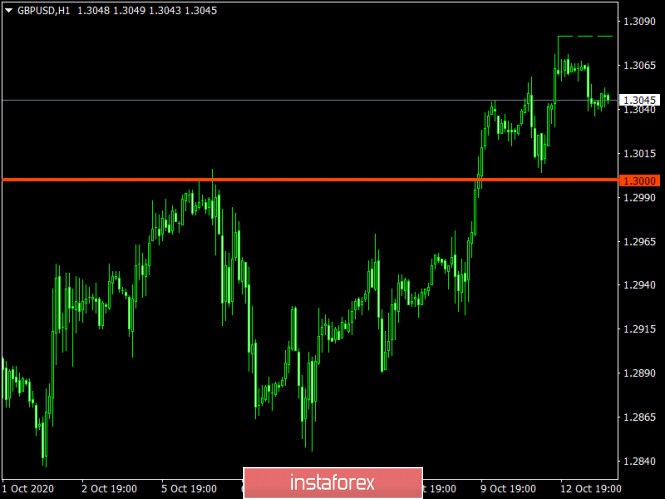

| Technical Analysis of GBP/USD for October 13, 2020 2020-10-13 Technical Market Outlook: The GBP/USD pair has broken out of the channel zone and now is trading around the technical resistance located at the level of 1.3059. The local high was made at the level of 1.3081. If the momentum still be strong and positive, the next target for bulls is seen at the level of 1.3121 and 1.3169. The nearest intraday support is located at the level of 1.3006. There is no sign of up trend reversal at the H4 time frame chart yet, but please notice the market conditions are starting to become overbought. Weekly Pivot Points: WR3 - 1.3328 WR2 - 1.3191 WR1 - 1.3137 Weekly Pivot - 1.2992 WS1 - 1.2933 WS2 - 1.2792 WS3 - 1.2730 Trading Recommendations: On the GBP/USD pair the main, multi-year trend is down, which can be confirmed by the down candles on the monthly time frame chart. The key long-term technical resistance is still seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518 is the reversal level) or accelerate towards the key long-term technical support is seen at the level of 1.1903 (1.2589 is the key technical support for this scenario).

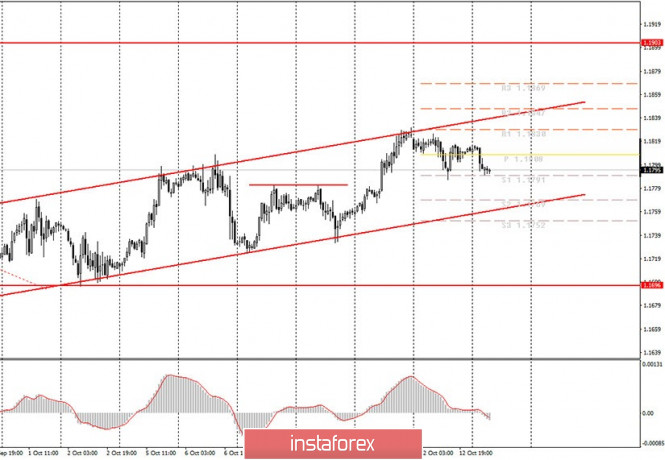

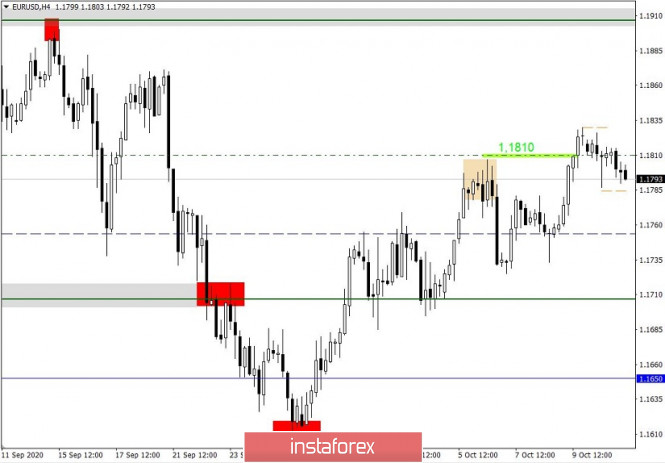

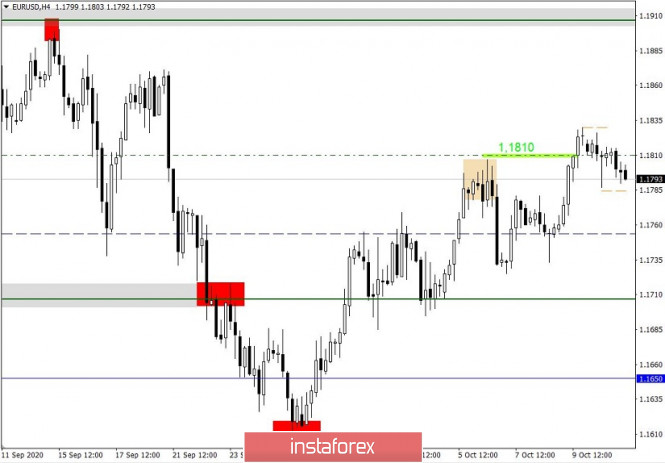

Technical Analysis of EUR/USD for October 13, 2020 2020-10-13 Technical Market Outlook: The EUR/USD pair has hit the level of 1.1822 again. This is the 61% Fibonacci retracement level on the weekly time frame chart and had been tested many times in the past. The momentum is still strong and positive, so bulls can break higher and hit the next target seen at the level of 1.1908. In a case of a failure here, the nearest technical support is seen at the level of 1.1790 and it being tested by bears. Any violation of this support will lead to another leg down towards the level of 1.1724. Weekly Pivot Points: WR3 - 1.2004 WR2 - 1.1916 WR1 - 1.1875 Weekly Pivot - 1.1792 WS1 - 1.1756 WS2 - 1.1665 WS3 - 1.1629 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up, which can be confirmed by almost 10 weekly up candles on the weekly time frame chart and 4 monthly up candles on the monthly time frame chart. Nevertheless, weekly chart is recently showing some weakness in form of a several Pin Bar candlestick patterns at the recent top seen at the level of 1.2004. This means any corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1445. The key long-term technical resistance is seen at the level of 1.2555.

Elliott wave analysis of EUR/JPY for October 13, 2020 2020-10-13

With the break below minor support at 124.33, it is clear that the rally from 122.34 has taken the shape of a leading diagonal, that completed with the test of 125.09 in wave i and wave ii is now in motion. The first corrective decline from 125.09 to 124.16 is in five waves indicating a zig-zag is in motion. After a minor rally to 124.73, we expect the second decline in wave c closer to the 50% corrective target at 123.71. Wave iv/ of one lessor degree completed at 123.80. Wave ii may well hit 123.71 - 123.80 wave ii to set the stage for the next impulsive rally higher to 127.02 and above. R3: 124.73 R2: 124.62 R1: 124.51 Pivot: 124.47 S1: 124.29 S2: 124.04 S3: 123.80 Trading recommendation: We have closed 50% of our long position from 123.10 at 124.35. We will re-buy EUR at 123.85 or upon a break above 125.09. Elliott wave analysis of GBP/JPY for October 13, 2020 2020-10-13

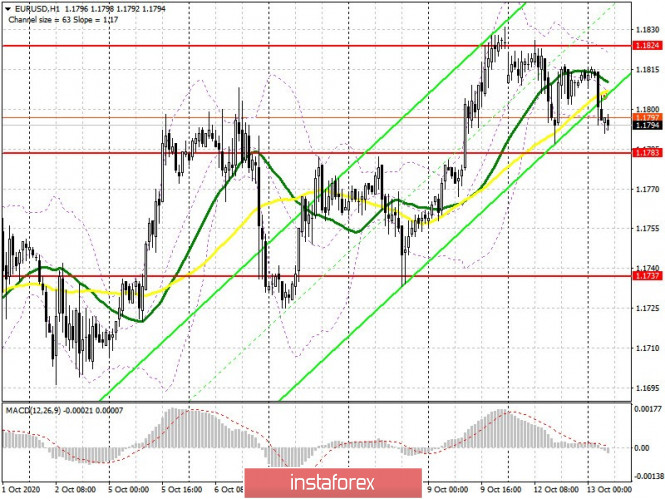

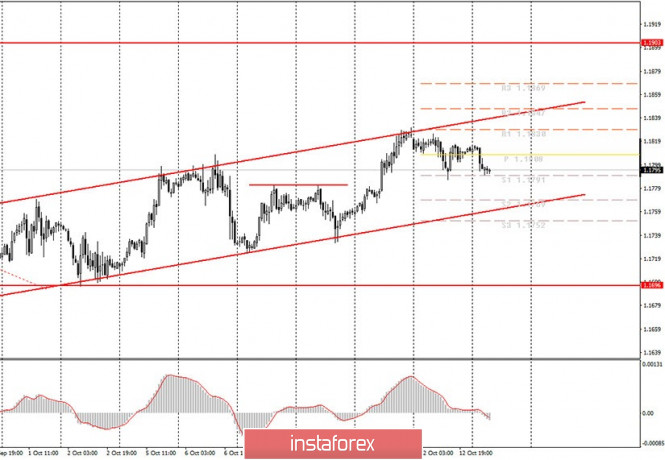

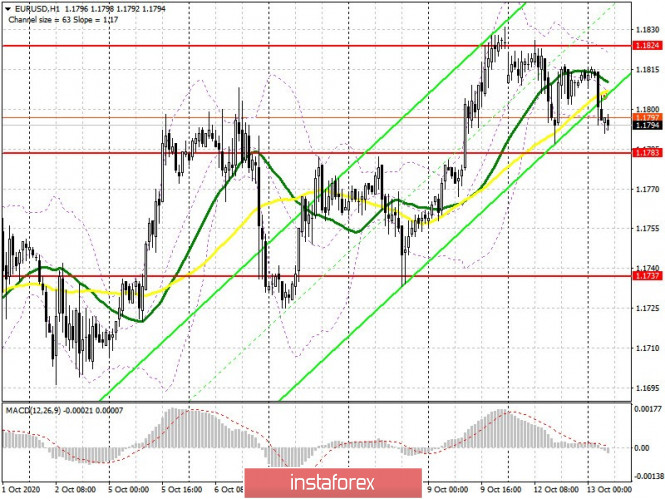

GBP/JPY has not yet broken below minor support at 136.77 to confirm that the rally from 133.08 has been a leading diagonal. Taking into consideration that this is the case for EUR/JPY the odds for GBP/JPY to produce a similar pattern is rather high. Therefore, GBP/JPY could break below minor support at 136.77 as red wave ii is moving towards the 38.2% corrective target ar 136.04 which is close to the low of red wave iv/ of one lessor degree at 135.78. So, red wave ii may hit 135.78 - 136.04. Once red wave ii is complete, a new rally to 147.72 and above is expected. R3: 138.36 R2: 137.87 R1: 137.68 Pivot: 137.42 S1: 137.19 S2: 136.84 S3: 136.38 Trading recommendation: We will take profit for 50% of our long GBP-position from 135.27 here at 137.47 and we will re-buy GBP at 136.15 or upon a break above 138.31. Analytics and trading signals for beginners. How to trade EUR/USD on October 13? Plan for opening and closing trades on Tuesday 2020-10-13 Hourly chart of the EUR/USD pair  The EUR/USD pair began a new round of corrective movement last Monday night, as we expected in yesterday's evening article. Thus, at the moment we conclude that the correction continues, and the price may fall to the lower line of the ascending channel. Take note that the price has reached the support level of 1.1791, the level from which it rebounded yesterday. Thus, it is quite possible that the correction will be completed in the near future. The MACD indicator has discharged to the zero level, as we wanted, so now we can look for new entry points to the market and wait for buy signals. In general, the trend for the euro/dollar pair remains moderately upward. Not too large a channel slope and frequent corrections indicate that buyers are not rushing to the market at breakneck speed. However, the sellers' positions are even weaker. The fundamental background for the EUR/USD pair, in principle, remains the same, as can be seen from the nature of the pair's movement, which does not change. To date, we will only receive minor reports from the European Union today, which are unlikely to pique the interest of traders. You can pay attention to these reports, but you should not wait for the market reaction to them. First of all, we are talking about inflation in Germany, which, like in the entire European Union, is already in deflation (negative inflation = falling prices instead of rising). According to experts' forecasts, deflation in Germany will remain so until the end of September. However, as we mentioned in yesterday's article, you should not attach too much importance to this factor. The euro has significantly grown in the past six months, which also affects inflation due to import-export operations. The same goes for US inflation, which is scheduled to be published this afternoon. In annual terms, this figure may be +1.4%. Inflation excluding food and energy products (more precise inflation) may be +1.7% y/y. However, the same thing - due to the strong decline in the dollar in recent months, this value can be misleading. In general, we believe that there will be no reaction today even to such important indicators as inflation. The whole world continues to recover from the coronavirus crisis, and is also preparing for its second wave. Therefore, almost all macroeconomic indicators, except for the most important ones, such as GDP, remain a formality at this time. Political and epidemiological factors remain in the first place in terms of importance. Possible scenarios for October 13: 1) Buy positions on the EUR/USD pair remain relevant at the moment due to the fact that the price continues to move inside the ascending channel. The downward correction may end near the support level of 1.1791. If the price overcomes this level before the MACD indicator turns up, forming a new buy signal, then the correction will continue to the lower border of the rising channel. When forming a buy signal, the targets will be the resistance levels 1.1830 and 1.1847. 2) Sell positions are currently not relevant. Traders could have earned several tens of points on a signal of a price rebound from the upper channel line, but we do not recommend opening new short positions at this time. To do this, you need to wait until the current upward trend has been cancelled, that is, for the price to settle below the upward channel. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Indicator analysis. Daily review on EUR/USD for October 13, 2020 2020-10-13 Trend analysis (Fig. 1) On Tuesday, the market from the level of 1.1814 (closing of yesterday's daily candle) can roll back down with the goal of 1.1749 to the retracement level of 38.2% (blue dotted line). After testing this line, the price will continue to work down with the target of 1.1723 - a pullback level of 50.0% (blue dotted line). However, all of this does not change the upward trend yet.

Figure 1 (daily chart). Complex analysis: - Indicator analysis - downward;

- Fibonacci levels - downward;

- Volumes - downward;

- Technical analysis - downward;

- Trend analysis - upward;

- Bollinger bands - upward;

- Weekly chart - upward.

General conclusion: The price from the level of 1.1814 (closing of yesterday's daily candle) can roll back down with the goal of 1.1749 to the retracement level of 38.2% (blue dotted line) today. After testing this line, the price will continue to work down with the target of 1.1723 - a pullback level of 50.0% (blue dotted line). Here's an unlikely scenario: when working down, after reaching the pullback level of 23.6% - 1.1781 (blue dotted line) - work up, with the target 1.1833 - upper fractal (blue dotted line). EUR/USD: plan for the European session on October 13. COT reports. Bulls' optimism is gradually fading away. Bears aim for breakout at 1.1783 2020-10-13 To open long positions on EUR/USD, you need: There were no signals for entering the market in the afternoon given the low volatility of the market, and Columbus Day in the US, although it is already obvious that Friday's bullish momentum is gradually fading away, and the pressure on the euro is returning. Nothing has changed from a technical point of view since none of the levels that we mentioned yesterday were tested. The only way for the euro to grow is if a breakout appears and the price settles above the resistance of 1.1824, which will open a direct road to new highs in the 1.1868 and 1.1915 areas, where I recommend taking profits. However, we can expect such a strong bullish momentum in the beginning only if the latest inflation indicators in Germany turn out to be good, as well as if we receive a high assessment of the sentiment of the eurozone business environment. The reports are scheduled for release in the first half of the day. If the pressure on the pair persists further, and this option is more realistic, testing support at 1.1783, where the moving averages pass, playing on the side of buyers, will become a more optimal buying scenario. However, it is possible to open long positions from this level only if a false breakout is formed there. If bulls are not active, I advise you to hold back from buying the euro to a larger support area of 1.1737, from where you can enter the market immediately on a rebound, counting on a correction of 30-40 points.  The Commitment of Traders (COT) report for October 6 showed a reduction in long positions and an increase in short positions, which led to an even greater decrease in the delta. Buyers of risky assets believe in sustaining the bull market, but prefer to proceed with caution, as there is no good news about the eurozone and the pace of economic recovery so far. Thus, long non-commercial positions decreased from 241,967 to 231,369, while short non-commercial positions increased from 53,851 to 57,061. The total non-commercial net position decreased to 174,308, against 188,116 a week earlier. which indicates a wait-and-see attitude of new players. However, bullish sentiments for the euro remain rather high in the medium term. To open short positions on EUR/USD, you need: The bears failed to emerge in the afternoon, since they did not reach resistance at 1.1828, and also failed to test support at 1.1783. An important task for the sellers of the euro is to form a breakout and settle below the 1.1783 area, which forms a new entry point for short positions with the goal of falling to a low of 1.1737, where I recommend taking profits. If the pair rises in the afternoon, one can expect a rebuff from the bears at the 1.1824 level. However, I recommend opening short positions from it only if a false breakout is formed there. In case bears are not active, as well as quite good data on German inflation, it is best not to rush to sell, but to wait until a larger resistance at 1.1868 has been updated, from where you can sell the euro immediately on a rebound, counting on a correction of 20-30 points within the day... Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which indicates a slowdown in bullish momentum. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator in the 1.1824 area will lead to a new wave growth for the euro. A breakout of the lower border of the indicator around 1.1794 will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

GBP/USD: plan for the European session on October 13. COT reports. Pound reacts to bad news 2020-10-13 To open long positions on GBP/USD, you need: Buyers of the pound managed to regain resistance at 1.3052 yesterday afternoon, however, they could not wait for a convenient entry point to enter long positions from there, since this level was not tested on the reverse side. The pound may continue to gain today as investors continue to ignore the bad news about the sharp rise in Covid-19 infections in the UK and the rather high likelihood of negative interest rates imposed by the Bank of England in the near future.  As for the GBP/USD pair's current picture, the bulls need to overcome the 1.3077 level in order to sustain growth. Only its breakout and consolidation forms a signal to open long positions, which can result in removing a number of sellers' stop orders and also strengthen the pair's upward trend to the high of 1.3154. The next goal is 1.3234, which is where I recommend taking profits. However, take note that we will receive quite an important data regarding the state of the UK labor market, which raises a lot of questions due to the state aid program. Therefore, we will not see the real picture this month either. But if the numbers deteriorate, the pressure on the pound will surely return. Therefore, in case the pair falls in the first half of the day, the emphasis will be placed on protecting the 1.3008 area, where the moving average is, which is now on the side of the pound buyers. Forming a false breakout there will be a signal to open long positions. If bulls are not active, I recommend not to rush to buy, but to wait for the test of the 1.2935 area and buy the pound there on a rebound, counting on a correction of 30-40 points within the day. The Commitment of Traders (COT) report for October 6 showed a minimal increase in short non-commercial positions from 51,961 to 51,996. Long non-commercial positions slightly rose from 39,216 to 40,698. As a result, non-commercial net position remained negative and reached -11,298 against -12,745, which indicates that sellers of the pound retain control and also shows their slight advantage in the current situation. The higher the pair grows, the more attractive it is to sell. To open short positions on GBP/USD, you need: Sellers need to defend resistance at 1.3077, where forming a false breakout will be a signal to open short positions in the hope of regaining the bear market. However, a more important task is to get the pair to settle below support at 1.3008, where the moving averages also pass, since this will return the initiative to the bears and lead to forming a larger movement to the 1.2935 area, where I recommend taking profits. We can expect to implement this option if the data on the UK labor market turns out to be much worse than economists' forecasts. If the pound grows above resistance at 1.3077, it is better not to rush to sell, since the market may continue to implement the bullish momentum from last Friday. Most likely, the bears will resort to protecting resistance at 1.3154, or it will be possible to sell GBP/USD immediately on a rebound from the 1.3234 high, counting on a correction of 30-40 points within the day. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which indicates a slowdown in bullish momentum. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator around 1.3077 will lead to a new wave of growth for the pound. A breakout of the lower border of the indicator around 1.3008 will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Trading plan for the EUR/USD pair on October 13. Persistent rise of coronavirus in Europe and growth in the US market. 2020-10-13

A noticeable decline can be seen in India's incidence rate, having recorded only 54 thousand new cases of coronavirus for yesterday. At the same time, the United States can observe an improvement in the situation as well, as it only reported 45 thousand new infections for yesterday. Europe, meanwhile, continues to record an increasing number of new cases daily, the most notable of which is in the UK, which recorded about 14 thousand. It was followed by Spain and France, which listed around 9 thousand, and the Netherlands, Belgium and Germany, which logged 5-6 thousand.

The announcement of a new US economic stimulus has fanned the rapid growth in the US market. Start selling when stocks break through the yearly highs.

EUR/USD - The euro keeps on rising as well so now, a new pivot has been found at the level of 1.1830. Set stop loss at 1.1740. Open short positions from 1.1720. Brief trading recommendations for EUR/USD on 10/13/20 2020-10-13

Yesterday, the EUR/USD pair failed to update the local high of 1.1830, which resulted in a pullback in the direction of 1.1800, where it stopped. The so-called "awkward price behavior" occurs when the shares of buyers and sellers are equal, which can subsequently lead to an acceleration in the market, but we'll talk about that more later. The range of 1.1800/1.1830 is brought together by the level of 1.1810, where the market stopped systematically. Now, we understand why there was an awkward price fluctuation and relatively equal market shares in this particular area. Relative to the current fluctuation, you can see a characteristic slowdown, but as soon as one or another border of the previously described area is broken, there will be a local acceleration in the market. Based on the location of the quote and the behavior of market participants, you can make a trading forecast from a number of possible market scenarios: First, the bulls won. The upward trend previously set in the market persists, which leads to an update of the local high of 1.1830, and this will direct us to a subsequent movement in the direction of 1.1870. Second, the awkward swing ends in a bearish rush. We should not forget that since the beginning of September, the market has been experiencing a downward tact, where the current movement is only a corrective move from the low of 1.1612. Thus, price consolidation below 1.1785 will lead to a surge in sellers, which can trigger the recovery process relative to the correction course.

Uptrend back in force to new highs for EUR/USD 2020-10-13

The trend and patience is your friends in the financial markets! Trading plan for EUR/USD and GBP/USD for 10/13/2020 2020-10-13 The market literally stood still yesterday, which was expected. Even Boris Johnson's harsh statements about the UK's readiness to do without a trade agreement with the European Union did not impress market participants. Perhaps, the point is that the UK's Prime Minister has made similar statements more than once, or maybe it was because he said it on the weekend, which was already forgotten by everyone by the beginning of the trading week. Moreover, an empty macroeconomic calendar is also not useful to any activity.

The market is currently not showing any activity, although the UK labor market data were simply disappointing. Here, the unemployment rate soared to 4.5%, against the forecasted 4.3% only. At the same time, employment fell by as much as 153 thousand, instead of 30 thousand. In other words, the situation on the labor market in the United Kingdom is rapidly deteriorating. And given the increasing risks of an unregulated Brexit, that is, without any trade agreement with the EU, the situation may be entirely disastrous in the near future. Unemployment rate (UK):

Apparently, investors are only waiting for US inflation data, which is forecasted to grow from 1.3% to 1.5%. This will move the market from a dead end. Given the fact that investors like to see an inflation rise, the movement will be purely towards the dollar's strengthening. Moreover, inflation should come even closer to the Fed's target levels. In other words, the inflation rise will not question the Fed's actions in the near future. The Federal Reserve will not soften the parameters of its monetary policy in any way which is against the backdrop of ECB's clear easing policy. Inflation (United States):

After an immediate growth, the EUR/USD pair found a resistance point within the 1.1830 level, where there was an initial pullback, which returned the quote below 1.1800. We can assume that holding the price below the level of 1.1800 increases the chances for a downward development in the direction of 1.1750-1.1700. An alternative scenario is considered if the upward trend resumes, where we will put special attention to the local high of 1.1830, since its breakdown can activate speculative interest in the market.

The GBP/USD pair recently managed to overcome an important price level of 1.3000, which led to a shift in trading interest and the emergence of speculative excitement. The pound is more likely to recover relative to the decline last month, if we hold the price above the level of 1.3000. At the same time, it is worth considering that a movement set in view of speculation is considered unstable and can change quickly. An alternative scenario will be considered if the quotes return below 1.2950, which will increase the chances of resuming the decline.

EUR/USD currency pair technical analysis for the week of October 12 to 17 2020-10-13 Trend analysis. The price for this week from the level of 1.1824 (closing of the last weekly candle) may start a pullback movement down with the goal of 1.1746 – a pullback level of 38.2% (red dotted line). When testing this level, continue working down with the goal of 1.1721 – a pullback level of 50.0% (red dotted line). If you move down from the level of 1.1694, you can start working up.  Figure 1 (weekly chart). Comprehensive analysis: - Indicator Analysis – Down; - Fibonacci Levels – Down; - Volumes – Down; - Technical Analysis – Down; - Trend Analysis – Down; - Bollinger Bands – Up; - Monthly Chart – Up. The conclusion of the complex analysis is a downward movement. Total calculation candles of the currency pair EUR/USD weekly chart: price of the week probably will have a downward trend movement with no upper shadows weekly black candles (Monday – down) and the presence of the lower shadow (Friday – down). The first lower target of 1.1746 is a pullback level of 38.2% (red dotted line). When testing this level, the next lower target is 1.1721 – a pullback level of 50.0% (red dotted line). Unlikely scenario: from the level of 1.1824 (closing of the last weekly candle), a downward movement with the target of 1.1746 – a pullback level of 38.2% (red dotted line). When testing this level, work up with the goal of 1.1830 – the upper fractal (red dotted line). GBP/USD: negative rate, positive negotiations 2020-10-13

The British pound is under significant pressure from two factors: the result of Brexit negotiations and the possibility of introducing negative interest rates. As a result, the pound is in between a fiery pit, experiencing serious volatility from time to time and seeking to find balance. Based on analysts' observations, the Bank of England has currently no plans to lower rates below zero, but is ready for such a step if necessary. At the moment, the key rate of the regulator is at the level of 0.1%. Andrew Bailey, BoE's Governor, said that if it moves into the negative zone, it could lead to an explosion of negative effects. If this plan is implemented, he intends to calculate and carefully weigh all the consequences that the introduction of negative rates may entail for business and the entire British economy. However, experts are still afraid that the financial stability and security of the country's banks will be under attack. The second key factor affecting the pound's fate is the unpredictability of the consequences of Brexit. According to Prime Minister Boris Johnson, London may refuse to negotiate with Brussels if an agreement on a transitional period is not reached this Thursday. However, experts emphasize that this deadline was set by the UK unilaterally, and its impact on the conclusion of a trade deal is exaggerated. It is possible that the negotiations will last for several weeks so that the parties can come to a compromise. In such a situation, the pound can take a break, which will support its rate and growth to the next level in the future. The current situation demonstrates the close dependence of the further dynamics of the pound on the result of Brexit negotiations. However, "not a single Brexit" determines the state of the British currency and its prospects. The success of negotiations between London and Brussels is still important for the market, but the disappointing macro data on GDP, industrial production and the UK trade balance also had an additional negative impact on the GBP. According to analysts' estimates, GDP's growth has slowed down, while industrial production volumes have significantly declined. The current indicators dissatisfied market expectations, creating additional problems for the pound. In such a situation, experts are sure that even a relatively favorable result of the negotiations will provoke high volatility of the British currency. Yesterday, the pound successfully broke through the "round" level of 1.3000. At the same time, analysts believe that the GBP/USD pair crossed this mark due to the dollar's total weakening. Monetary strategists at Unicredit say that GBP will consolidate above the level of 1.3000 in case of a positive result of the negotiations. However, the negative outcome of the meeting will have a stronger impact on its dynamics than a possible compromise. In case of failure of negotiations, the pound will face a large-scale sale, while the GBP/USD pair will decline up to 1.2500. At the moment, this pair is quite calm and is trading near the range of 1.3044-1.3045, trying to gain high. According to the assessment of economists and currency analysts, political and economic uncertainty now rules the world stage. According to the monetary policy Committee of the Bank of England, the main factors of such uncertainty are trade tensions between the US and China, the upcoming US presidential election, COVID-19 pandemic and the risk of a "hard" Brexit. However, optimism is gradually gaining control, and the regulator is inclined to believe that the Brexit issues means nothing much compared to COVID-19 and global geopolitical tensions. Nevertheless, experts conclude that these factors have a stronger effect on financial stability in the United Kingdom and in the world. EUR/USD and GBP/USD: UK introduces new restrictions amid rising COVID-19 infections. The euro and the pound will continue to be in demand, but under a number of conditions. 2020-10-13

UK Prime Minister, Boris Johnson, has announced new local restrictions related to the coronavirus, and the reason for this is the massive increase of infection rates recorded in various parts of the UK. So, starting from Wednesday, three new levels of anxiety will be introduced - medium, high and very high, but even so, schools and retail outlets will continue to operate, as no one is planning to close them yet. At the same time, a rather interesting statement was made by the WHO yesterday, as representative Melita Vujnovich proposed to stop the imposition of strict quarantine measures, which contrasts the organization's recommendation six months ago - to undergo complete isolation during the pandemic, which led to the sharp collapse of the world economy. Vujnovic said that today's response should not be the same as in February, especially since the world already partially knows the virus and that there is already an understanding on how to deal with it further. The imposition of severe social restrictions will only worsen the economy and cause irreparable harm to it, thereby making the poor even poorer. She also noted that quarantine measures will hit not only the economy,

Another factor that puts pressure on the British pound was the news that the Bank of England is asking British banks on how prepared they are for a zero or negative interest rate, which confirms the intention of the Central Bank in resorting to softer monetary policy. Deputy Governor Sam Woods has already announced that specific information on the current readiness of the business to deal with a zero or negative bank rate, as well as a multilevel system for creating reserves, is already being requested. However, amid all these negative news, the British pound continues to float, even managing to renew monthly highs. Apparently, the increasing possibility of a post-Brexit deal is preventing the currency from declining, and the success of which will definitely trigger a new wave of growth in the GBP / USD pair. But, traders should also be prepared in case negotiations fail this week, as such would put even more pressure on the British pound. So, for the technical picture of the GBP / USD pair, the bulls need to push the pound above the resistance level of 1.3080, in order to reach a quote of 1.3155 or 1.3240. On the other hand, the pound will drop down if the price returns to the support level of 1.3000, and such will quickly push the pair to a quote of 1.2930 or 1.2845. As for the European currency, it is currently trading in a narrow sideways channel, after stopping yesterday at monthly highs. The bullish momentum has completely dwindled after increased speculation that the European Central Bank may increase its quantitative easing program, as its chairman, Christine Lagarde, has repeatedly stated this last week. The main problem in Europe is the slowdown and stagnation of economic indicators after growing sharply in the 3rd quarter, which signals the possibility of additional stimulus measures.

Meanwhile, data on German inflation will be released today, which, if reveals a slowdown in inflationary pressures, will serve as an additional signal that the ECB will not wait long in expanding the PEPP program. Back to the EUR/USD pair, resistance is seen on the level of 1.1830, but a breakout from which will lead to automatic triggering of sell stop orders and a new jump of the trading instrument up to the highs of 1.1870 and 1.1915. The key target of the bulls remains the psychological mark in the area of the 20th figure. However, if pressure on the euro returns this week, the pair will head towards the support level of 1.1780, and then decline to a quote of 1.1735. Technical analysis of USD/JPY for October 13, 2020 2020-10-13  Overview : - Yesterday, the USD/JPY pair reached a new minimum at the price of 105.40. So, today the price may reach one more minimum around the spot of 105.23, which coincides with the ratio of 23.6% Fibonacci. Today, the USD/JPY pair is challenging the psychological resistance at 105.54. So, the first resistance is seen at the level of 105.54 in the one-hour time frame. We expect the GBP/USD pair to continues moving in a downtrend below the level of 105.54 towards the first target at 104.96 so as to test the double bottom. Major support is found at the level of 104.70. We guess that the pair will be traded lower in the early session and try to reach minor support at the level of 105.23. The bias is neutral in the nearest term probably with a little bearish bias testing 105.23 area, which needs to be clearly broken to the down side to keep the bearish scenario. RSI (14) has made a recent bearish Letout which is in line with the bearish exit we're seeing in price. On the downside, a clear break at the level of 104.96 could trigger further bearish pressure testing 104.70, which represents the major support today.

Forecast : As a result, it is gainful to sell below this price of 105.54 with targets at 104.96 and 104.70. However, the bullish trend is still expected for the upcoming days as long as the price is above 105.86. Daily Technical level : - Major resistance: 106.12

- Minor resistance: 105.86

- Intraday pivot point: 105.54

- Minor support: 104.96

- Major support: 104.70

Author's today's articles: Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. Mihail Makarov  - - Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Alexandr Davidov  No data No data l Kolesnikova  text text Pavel Vlasov  No data No data Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.

Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  -

-  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  No data

No data  text

text  No data

No data  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

No comments:

Post a Comment