| | Amanda Heckman

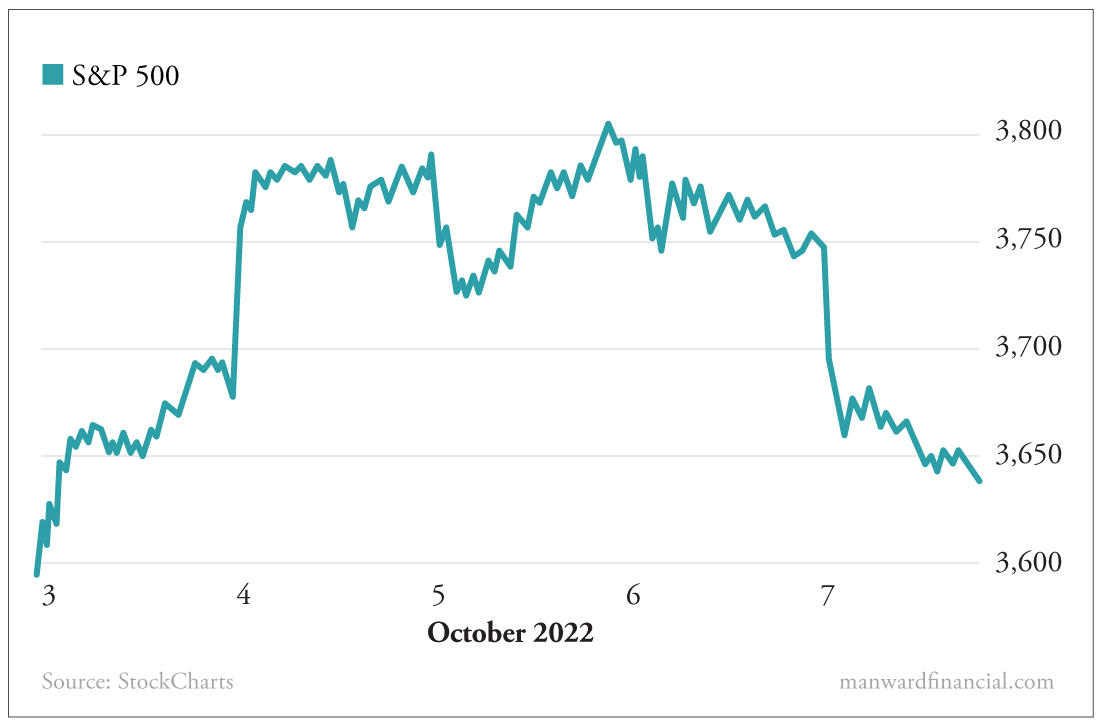

Editorial Director | The market's roller-coaster ride this week can be summed up easily... This is what happens when you pin all your hopes and dreams on one person. The market is hoping and praying Jay Powell and his Federal Reserve will finally reverse course on interest rate hikes. Every piece of news, every word spoken, every data point released... sent the markets into a tizzy. And that's causing a lot of grief for investors. [Controversy: Bill O'Reilly's "Money Man" Said What About the Biden Presidency?] The markets shot 4% higher earlier this week in a series of "bad news is good news" trading. The Bank of England's decision to buy bonds in order to stabilize the U.K.'s free-falling debt market, combined with Australia's decision on Tuesday to slow its pace of rate hikes, raised hopes the trend would continue here... We also got word that U.S. job openings saw their biggest fall in more than two years in August. Did the news mean the Fed would pull back on rate hikes or even cut rates? Nope. The folks at the Fed came out in droves this week to defend their rate hike efforts. In separate remarks, we heard from... - Fed Governor Christopher Waller

- Chicago Fed President Charles Evans

- Minneapolis Fed President Neel Kashkari

- Cleveland Fed President Loretta Mester

- Fed Governor Lisa Cook

- Fed Governor Philip Jefferson.

All were united in the message that they will keep raising rates until inflation is properly tamed. And then... The other shoe dropped. On Friday, the Labor Department reported that employers added a larger-than-expected total of 263,000 jobs last month. As a result, the unemployment rate fell from 3.7% to 3.5%. It was the opposite of what the markets wanted. Slowing labor demand is at the center of the Fed's battle against inflation. And the persistent strength of the jobs market means the Fed has more work to do. That means more rate hikes... Another 75-basis-point hike next month now seems all but certain. The markets reacted to this news as you'd expect... falling off a cliff at Friday's opening bell and trending down from there. In this week's monthly video call with his paid subscribers, Andy talked about the tough road ahead for the Fed. He said, "This is going to take a long to time play out, and the markets aren't going to like that. It's going to be volatile." He continued, "But to save the nation and its currency, I think rates have to go higher. To save the stock market, that's a different story. That's not the Fed's job." Sure seems like the markets need a reminder. This oddball indicator can tell us when to get in... and when to get out with some profits. Using a few charts, Andy shows you exactly how to use it and what it's telling us now. Check it out here. This electrical parts maker empowers and energizes communities in front of and behind the meter. And with profits expected to grow by 35% over the next couple of years, the company's future looks bright. Get all the details on the stock - including its ticker - in this week's Stock of the Week video. Click here or on the image below to watch it. "Inflation must come down, and we will keep at it until the job is done."- Federal Reserve Governor Lisa Cook Want more content like this? | | | | | Amanda Heckman | Editorial Director Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years sharpening Andy's already razorlike wit... and has worked with numerous bestselling authors and award-winning financial gurus along the way. | | | |

No comments:

Post a Comment