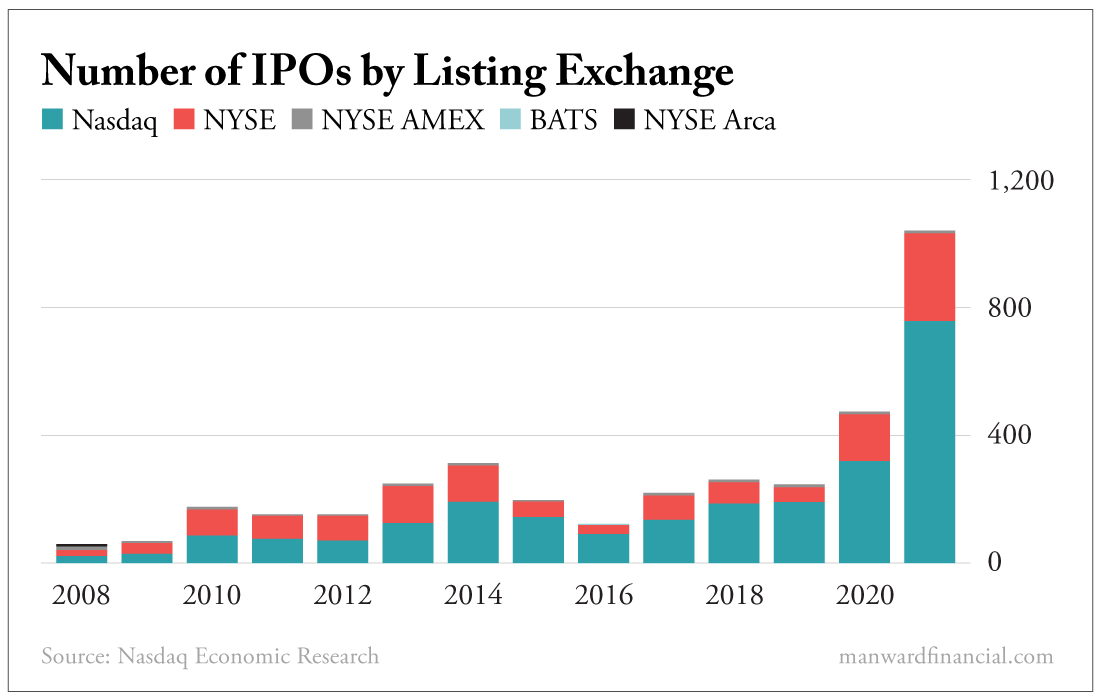

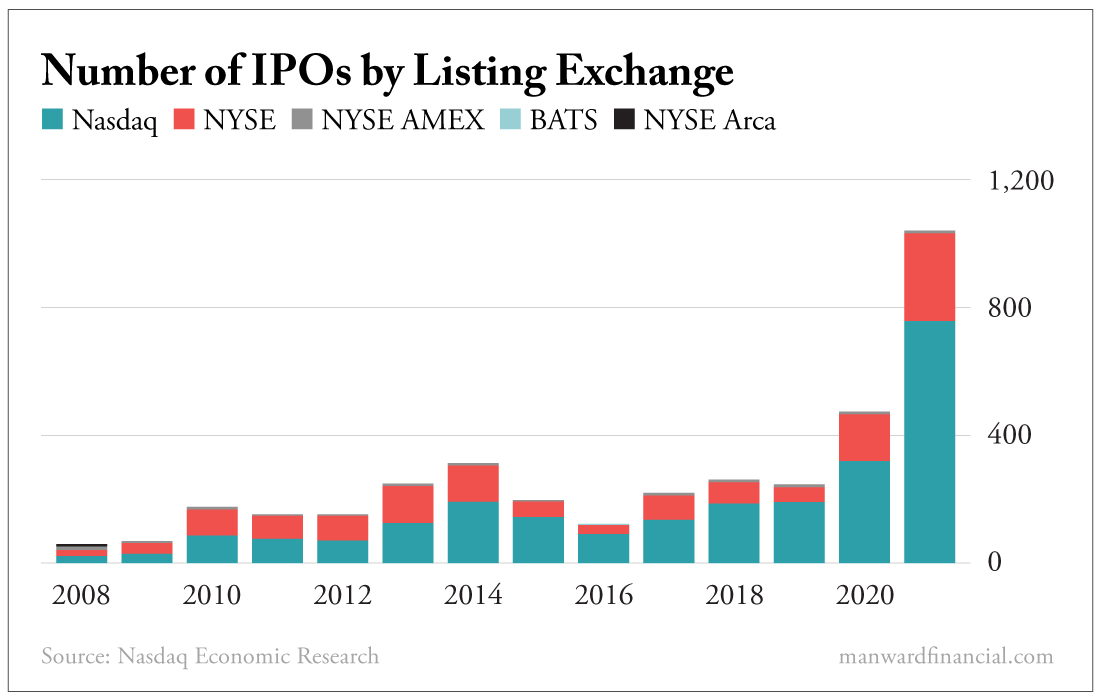

| | Robert Ross | One of the most common questions I received in 2021 was... "Are you going to buy [insert popular IPO stock] when it goes public?" The reason for all those inquiries was clear. 2021 was the biggest year for IPOs in a decade.

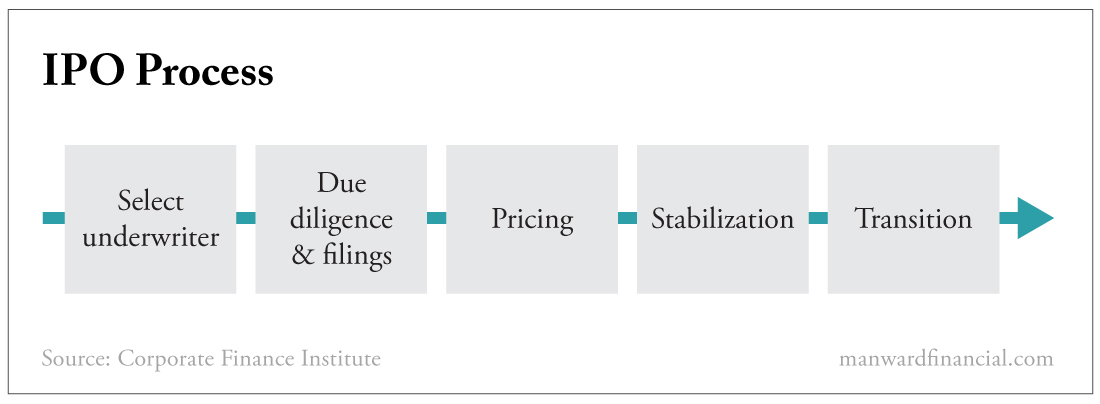

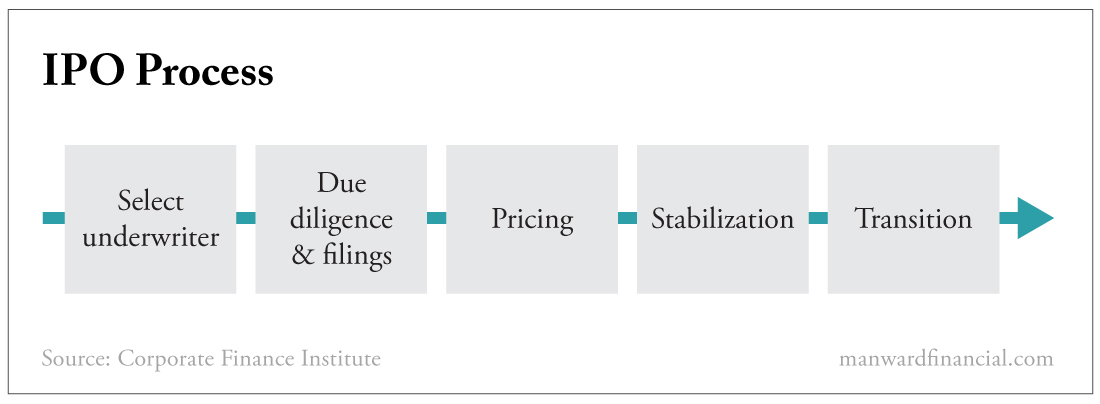

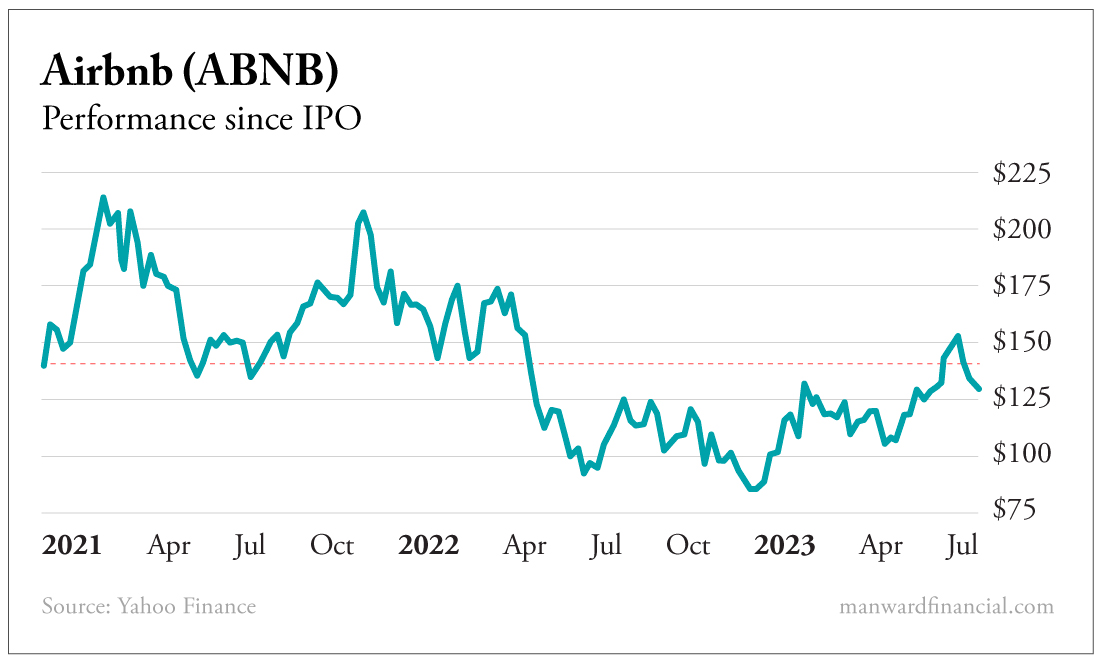

View larger image But while buying into firms like Airbnb (ABNB), Robinhood Markets (HOOD) and Rivian Automotive (RIVN) was tempting, my response was always the same: I never buy an IPO close to the offering. [Could Top AI Stocks Surpass the Unrivaled Growth of Top Tech Stocks? This Expert Says Yes... and Names One Cheap Stock His Favorite for 2023. ] ] That's because "hot" IPOs have a long history of underperforming in the six to 12 months after the offering. After that, however, is the perfect time to look at these businesses. Getting the Right Underwriter Is Key If you want to invest in IPOs, it helps to understand how companies go public. Bringing a company from its humble beginnings to an IPO is a major milestone. As an investor, you need to know the key criteria that separate the winners from the losers. The best place to start is identifying who underwrote the IPO. An underwriter is a bank that evaluates and assumes the risk associated with a company's IPO. The underwriter determines how risky the company is... how the stock should be priced... and other criteria for bringing the company to market.

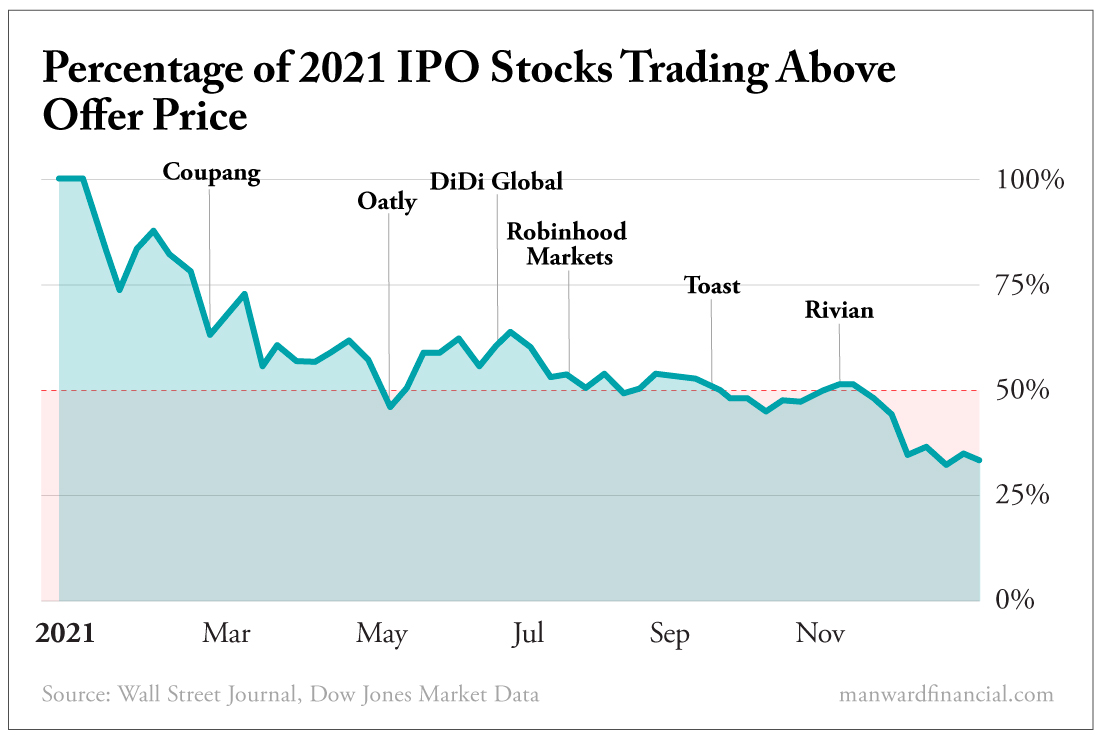

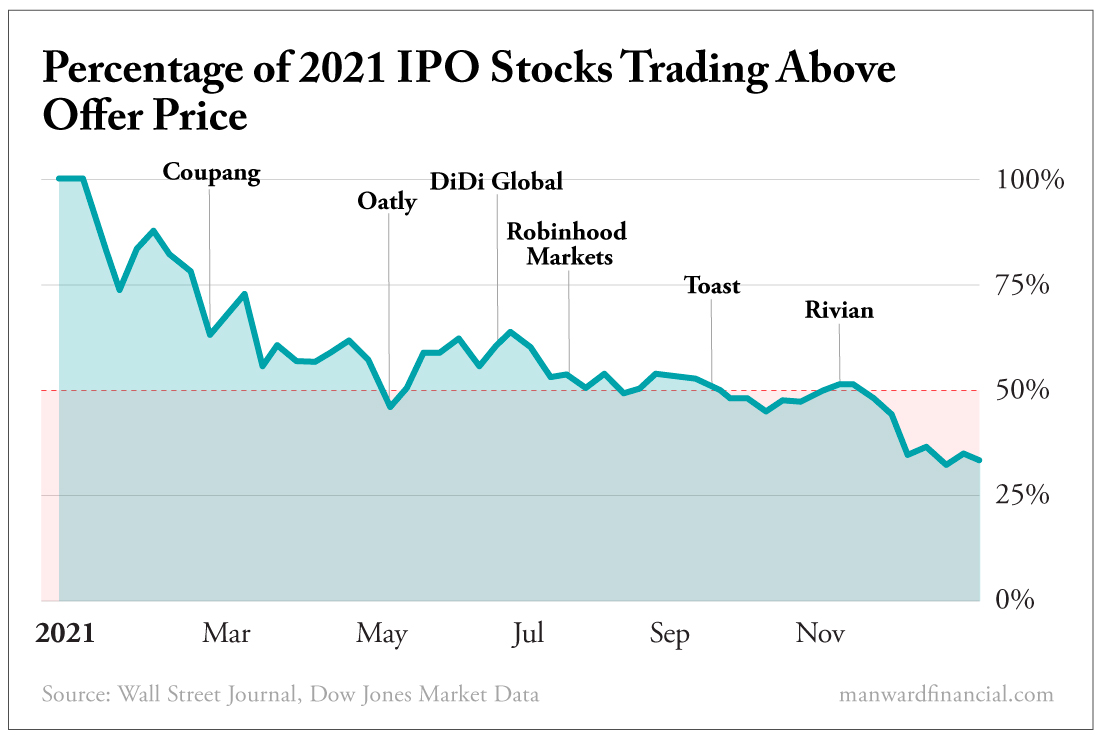

View larger image The most prestigious and reputable underwriter is Goldman Sachs. Having a well-established firm like Goldman Sachs underwrite your IPO is a huge vote of confidence. The bank can be very picky when choosing which companies to bring public. Most pre-IPO businesses would love for Goldman to be their underwriter. And since Goldman has its pick of the best potential IPOs, it follows that any company the bank brings public is of good quality. Bank of America, Morgan Stanley and JPMorgan Chase are also top-tier underwriters. If any one of these companies is bringing your prospective IPO public, you're in good hands. Patience Is a Virtue The second thing you want to watch is the lockup period. When a company goes public, insiders must wait a mandated period before selling any of their shares. This is often 90 to 180 days after the IPO date, but it can be as long as 12 to 18 months. Lockup periods are meant to prevent insiders from dumping large amounts of shares at once. A study from New York University showed that on the day after a stock's lockup period ends, it tends to fall 1% to 3%. Most companies sell roughly 20% of their equity when going public. Therefore, if a single large shareholder dumped their 15% stake on IPO day, it would potentially send the stock price spiraling. Plus, if there's lots of insider selling on an IPO, it sends a negative sign to investors. If you're interested in an IPO, keep a close eye on the end of the lockup period. Wait until after the lockup expires before opening a position. Follow the Smart Money Managers of institutional investment funds (such as hedge funds and pension funds with assets over $100 million) file something called a Form 13F with the SEC every quarter. This form discloses all stocks owned by the institution. Most importantly for our purposes, this form shows changes to the institution's stock holdings. Since these filings are published every three months, you can use them to see if any of the top hedge funds bought the IPO you're monitoring. If top funds are investing in your IPO candidate, you should take note. Some of the best-performing hedge funds I follow include Bridgewater Associates, Duquesne Family Office and Elliott Investment Management. Get Your Checklist Together If you find an IPO you want to buy, the best action you can take is to not buy it on IPO day. This is especially true with hyped IPOs like Airbnb, Snowflake and Rivian. Because when the initial euphoria wears off, you often see huge pullbacks in the stock.

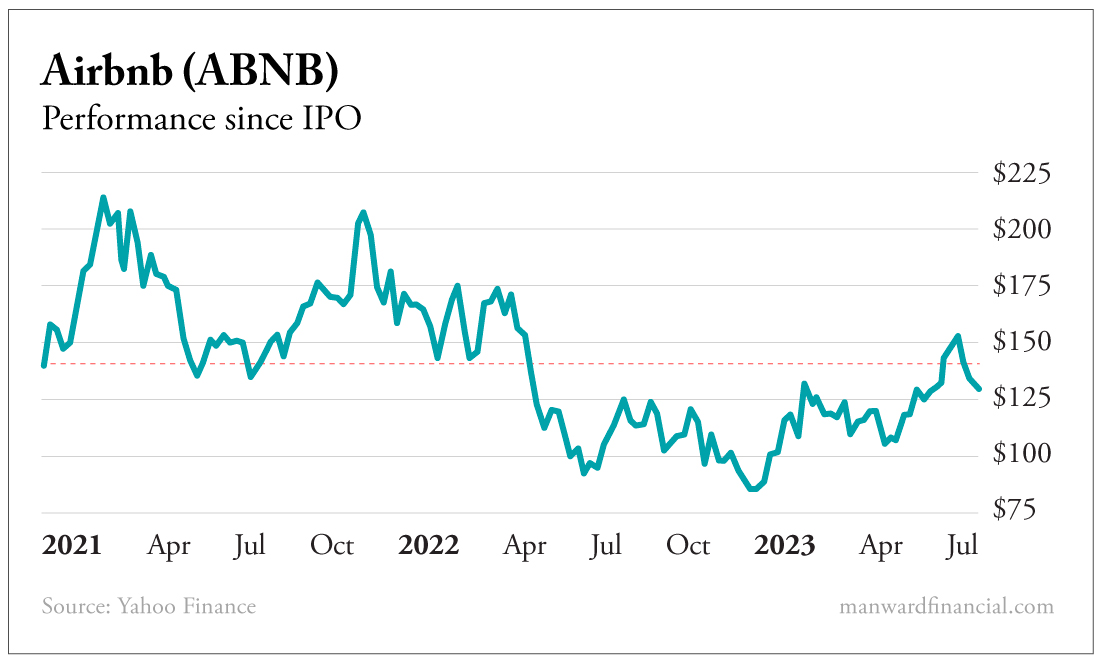

View larger image Of course, how far a stock pulls back tells us something too. It's a good indicator of how great the underlying business is. So which IPOs from 2019, 2020 and 2021 have held up best? The top three on my list are Airbnb, Datadog (DDOG) and Warner Music Group (WMG). If I had to pick one, I'd go with the king of short-term rentals: Airbnb. After a tough 2022, the stock has rallied back near its IPO price...

View larger image And with a profitable underlying business, Goldman Sachs underwriting the IPO and 64% of shares owned by institutions, it checks all my boxes. Remember these criteria the next time you're thinking about buying a newly debuted stock. They could help you maximize your profitability... and avoid a lot of trouble. Stay safe out there, Robert Want more content like this? | | | | | Robert Ross Robert Ross' unique style of clear and direct stock research has helped him build a massive following in the investment research industry. He started his career at investment research company Mauldin Economics, where he quickly rose through the ranks to become the youngest chief analyst in the industry. Today, over a million investors turn to Robert every month for his take on investing, economics and personal finance. He now shares his unique insights in Manward Financial Digest and Manward Letter. | | | |

No comments:

Post a Comment