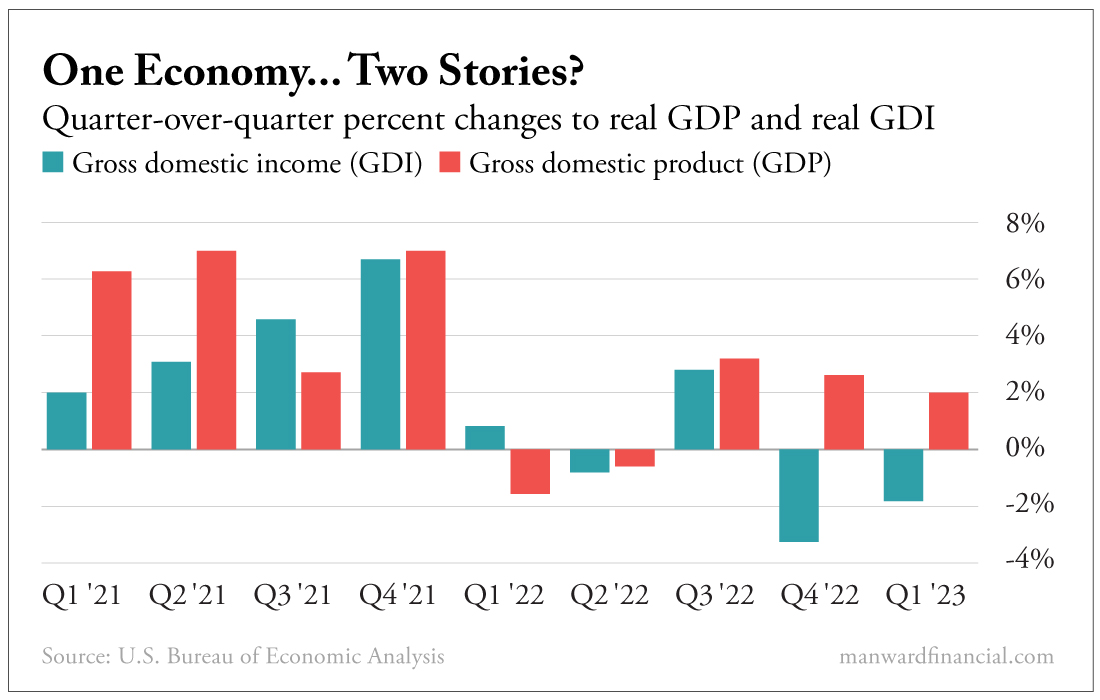

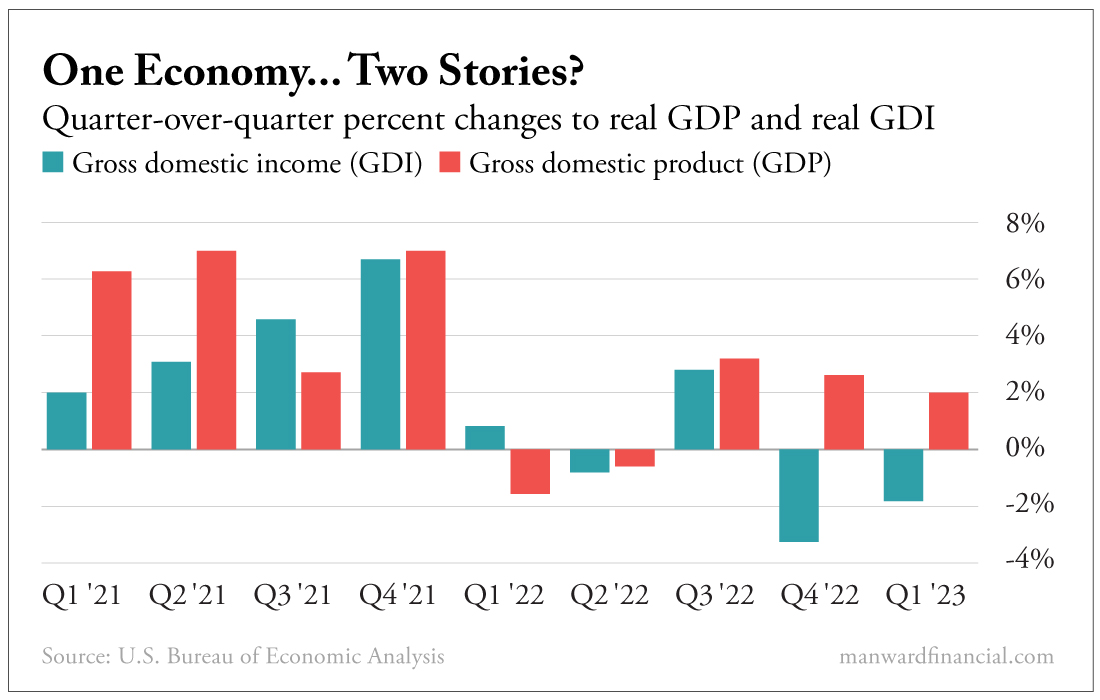

| | Anthony Summers | Somewhere in the deep recesses of Washington... a chorus of voices is rising from the abyss, singing praise to Jay Powell... "For he's a jolly good fellow... for he's a jolly good fellow..." Not so fast. The Fed's inflation fight may be ending - and rate hikes along with it - but something just seems... wrong. (And I'm not the only one to notice.) Let's look at some strangely overlooked facts. [Two Recent Ultra-Cheap (Under $5) Penny Options Made 131% and 115% in Under 49 Days. Discover How You Can Get the Next Recommendation Here. ] ] There's a very puzzling discrepancy going on between two key measures of the economy... Gross domestic product (GDP) and gross domestic income (GDI). GDP is the go-to measure of the economy. It makes the headlines. It's on the lips of every advisor, analyst and talking head. But it's only one way to tell the story. | SPONSORED | | Why is no one talking about huge July 25th "Twist" in U.S. Economy? A forensic accountant and U.S. Pentagon consultant says this should be the biggest story in America today, but it’s receiving almost no coverage: A huge new economic development could make many Americans vastly wealthier and alter the course of the 2024 presidential elections. But there’s a huge downside too. Details here… | | | Same but Different GDP measures the value of goods and services sold in the economy. GDI measures the income earned from selling those goods and services. Both should be identical... because they measure what amounts to the same thing. But due to discrepancies in the data sources used, they're usually not identical. Regardless... here's what they should do: tell the same story. If the economy's growing, both metrics should show it. If the economy's not growing, both metrics should show that. Right? Unfortunately, life isn't that simple. GDI and GDP have been telling us very different stories for quite a while now. GDI's story suggests that the recession Jay Powell has been trying to avoid has already started.

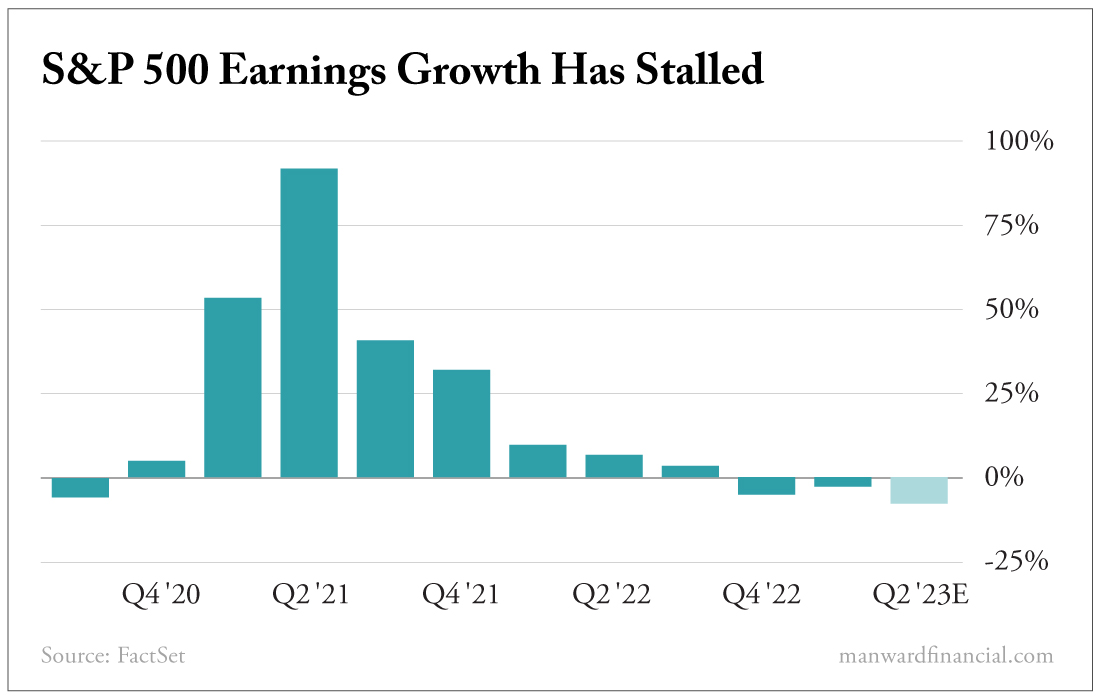

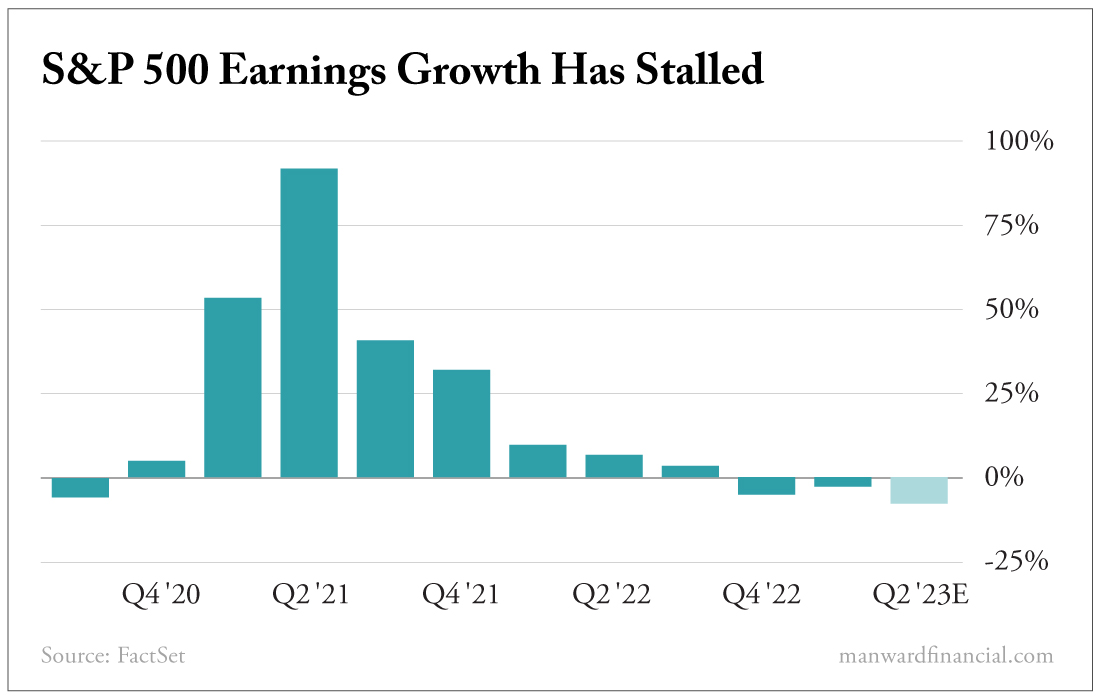

View larger image You can see in the chart that while GDP growth has remained positive... GDI growth has gone negative... and not by a little. Given these two narratives, which do you believe? Don't answer that just yet. Let's turn our attention to another oddity. | SPONSORED | | 💥 Commodities Boom: Don't Miss It! 💥 Join Buddy Pittman and Marc Lichtenfeld at the Commodities Supercycle Summit to learn about the biggest commodities boom of our lifetimes. Don't let this once-in-a-lifetime opportunity slip away... Click here now. 📈🌟  | | | Stunted Growth While the S&P 500 has rallied nearly 18% this year, another strange trend seems to be escaping many people's notice. That is... the S&P 500 has been in an earnings recession for at least six months now. In fact, the index is on track to report a third consecutive quarter of negative earnings growth - a trend that began in the last quarter of 2022 - if current earnings estimates are to be believed.

View larger image Even worse, the index is expected to report its first quarter of revenue decline since late 2020. Huh. Well, that's not good, either. Of course, analyst estimates are not perfect... by design. They tend to be conservative in order to juice surprises to the upside. As a result... the official earnings growth rate for the S&P 500 has topped end-of-quarter estimates in 37 of the past 40 quarters. But what's more meaningful here is the direction the estimates point to - whether growth is expected to be positive or negative - rather than its exact magnitude. And at best, the data suggests we're in the middle of a very serious slowdown in corporate earnings. None of this seems to bode well for the health of our economy. The fact is, the folks at the Fed have got a long way to go before they should start patting themselves on the back. But it seems like they've already started ordering the party hats and confetti poppers. Investors would be wise to not join in the festivities. Invest wisely, Anthony Want more content like this? | | | | | Anthony Summers Anthony Summers is the Director of Strategic Trading for Manward Press and a contributor to Manward Financial Digest, Manward Trading Tactics and Manward Letter. He is a former senior analyst for The Oxford Club, where he closely worked with some of our nation's sharpest financial minds for nearly a decade. Anthony is a self-styled "conservatively aggressive trader" and has earned a reputation for developing unique trading strategies that focus on low-risk, high-return opportunities in both stock and options markets. | | | |

No comments:

Post a Comment