You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Deflationary Scenario... Explored...I have a funny feeling... that something much bigger is happening...

Dear Fellow Traveler, On Thursday, the Bureau of Labor Statistics released its January CPI report. Headline inflation came in at 2.4% year-over-year… an eight-month low and the coolest reading since spring 2021. I think that really confused a lot of people, especially those who had been expecting inflation to resume. Core inflation fell to 2.5%, and energy costs were down by about 1.5%. On the surface, this is all good news. The headline talk about the Federal Reserve is that policy is working to cool inflation… which is curious given that economic conditions remain so loose… Break out the Except… nobody on Wall Street seems to be celebrating. The S&P went lower… the Nasdaq fell harder. And if you were watching the momentum screens over at Capital Wave Report, you already knew... Momentum remains negative (even though hedge funds were loading up on technology stocks at their fastest rate since 2021). Today, I want to talk about scenarios… because that’s how I think. If a specific scenario presents itself, I want to be prepared… And the “unthinkable” scenario is that inflation collapses, leaving us facing the threat of deflation. As I said… tariffs are - in the long run - lean deflationary. I took a few snarky hits for that argument… but then the Fed released research in November 2025 supporting my view. That said, let’s talk about what happens if deflation comes to town. Spoiler alert: They’re going to print money. The Two CampsThere are smart people who believe inflation is coming back with a vengeance. They’re taking the 1970s approach… pointing to electricity costs, material prices, tariffs, and sticky services. Your haircut is getting more expensive. So is your insurance. The plumber still charges what the plumber charges. They have a point. Services inflation is real and stubborn. But… I remember sitting at a dinner in early 2008 with my former boss. Sherri laughed when I said I was concerned about inflation at the time. She looked at global supply chains and the ongoing fiscal worlds and said… “I’m more worried about deflation.” She was right. Like… she had a time machine into the future… Even after the Fed pumped $1.75 trillion into the system through the first round of Quantitative Easning… buying mortgage-backed securities, agency debt, and Treasuries at a pace nobody had ever seen… the U.S. still posted negative CPI in 2009. We had actual deflation… with the first QE experiment running full speed. This is why various economists said that the 2008 Stimulus wasn’t big enough… Think about that for a second. The largest monetary intervention in history at the time, and they still couldn’t stop prices from falling. Bank lending contracted by $1.3 trillion over the next 10 quarters… That was the largest post-WWII credit contraction on record. By December 2008, the bond market was pricing in a 98% probability of deflation over the following year. People don’t remember this because life was a blur between the time Lehman Brothers collapsed and the Fed started QE in March 2009. The Blinder-Zandi counterfactual model is the most comprehensive study on what would have happened without QE… It is estimated that GDP would have contracted by 12% to 14%, rather than just 4%. Unemployment would have hit 16.5%. They said this would have been a “1930s-like depression.” And in the actual 1930s, when there was no QE and the gold standard still constrained the Fed, consumer prices fell by 25% over the decade. That can’t be debated… The Price of TomorrowKeynesian economics is build on debt… and more of it… and money printing… and inflation… and extracting time and energy from everyone. And I’ve been writing about the next chapter of this for longer than most people realize. In 2021, I wrote a piece for Modern Trader called “How I Learned to Stop Worrying and Started to Love Deflation” that explored this exact question. I interviewed Jeff Booth, who had just released his book “The Price of Tomorrow,” and his thesis was simple but uncomfortable…

That was 2021. This was before ChatGPT or before Claude could write 57 articles in my voice in the time it takes me to draft one. That was before C.H. Robinson dropped 24% in a day because an AI freight platform could handle four times the load of a human broker. I asked Booth whether technology reduces prices. His answer…

He was right then. And the exponential part is the keyword now. The Deflationary ScenarioHere’s the case for deflation that I think you need to at least consider. AI is estimated to create an annual drag of 0.5 to 0.7 percentage points on CPI. McKinsey’s data shows that most firms are now reporting material cost reductions in white-collar functions due to generative AI. Sam Altman has called AI “massively deflationary.” Five million white-collar jobs are staring down extinction, according to Microsoft’s data. The accountant preparing your taxes? He’s being replaced. The analyst writing your research report? She’s being replaced. The broker matching your freight? They’re already replaced… that’s the C.H. Robinson story. CBRE dumped 21% in 48 hours after an AI suite launched that automates lease auditing and property valuations. Sure, services are sticky. The guy with the scissors is safe for now. But when the labor costs behind services start compressing… the stickiness unsticks. In that 2021 piece, Booth made a comparison between electricity and AI that has stuck with me ever since.

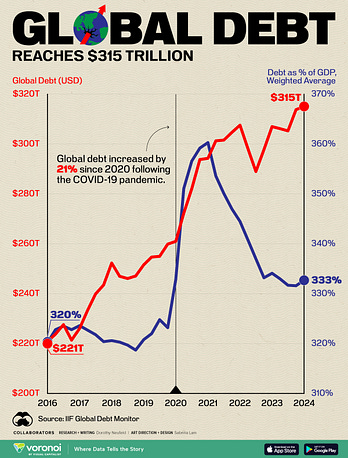

He also offered a way to understand exponential growth that I’ve never forgotten. A single sheet of paper folds seven times. But if you could fold it 50 times… it wouldn’t reach the ceiling. It would reach the Sun. That’s 93 million miles. That’s the deflationary force we’re dealing with. And the 2.4% CPI print isn’t the end of the cooling. It could be the beginning. Doesn’t matter if I think that all roads point to more monetary inflation… It’s how we get there that matters… All Roads Point to “Brrrrr”Central banks don’t do deflation. They can’t. Not after Ben Bernanke… A fiat system requires growth and inflation to service existing debt. When you’ve got $346 trillion in global debt… roughly 310% of world GDP… deflation isn’t just inconvenient. It’s an existential threat. We already have the proof. In 2009, the Fed threw $1.75 trillion at the problem and still got deflation. The system was so broken that every new dollar they created disappeared from bank balance sheets rather than flowing into the economy. Now imagine that same deflationary pressure… but instead of a credit crisis causing it, it’s a permanent technological force that gets stronger every six months. I wrote about this in 2021, too. At the time, Booth pointed out that governments had created $185 trillion in new debt since 2000… yet that debt had generated only $46 trillion in economic growth. Every new dollar of debt was producing fewer than 35 cents of GDP. The returns were diminishing, and the system was getting more fragile. Booth put it plainly…

So what happens when AI pushes the economy toward deflation while the debt load requires inflation? You already know the answer. Fed Nominee Kevin Warsh is set to replace Jerome Powell as Fed chair in May. He’s talking a good game about how the Fed’s balance sheet isn’t going to increase… Rate cuts are being priced in by June. And that’s before the full deflationary impact of AI has registered in the data. The money printer is already on with Reserve Management or whatever the hell it is we’re calling this non-QE program that aims to achieve QE-like outcomes. But if we start to drift into a deflationary environment… Especially as we are facing possible military challenges and new threats… Expect the full force of the BRRRRR to come alive. All… Roads… Point… To… More… Monetary… Inflation. The money printer is a key tool in protecting power. That and… there is no other playbook. What This Means for Your PortfolioGold is sitting above $5,000 an ounce. JPMorgan has a target of $6,300. Bloomberg is actually calling this “the debasement trade.” They’re using our word now. Just 23 months later… And while the SaaSpocalypse ripped $1 trillion out of legacy business models last week… gold reclaimed its highs and kept climbing. That’s “convexity” doing exactly what it’s supposed to do. Scarce assets rising while everything else takes a bat to the face. [Editor’s Note: I said “convexity”… drink!] This is why we’ve been hammering the productive and scarce framework. When the printer fires up, it doesn’t lift all boats equally. It lifts the ones generating real cash flows above the debasement rate… and the ones that can’t be diluted. It also quickly takes higher-beta stocks that are supported by leveraged flows, passive flows, and old-school efficiency investors much higher… I don’t know which camp will be right. Maybe inflation roars back, and the 1970s crowd takes a victory lap. But if the deflation scenario plays out… and the data is starting to suggest it might… then the policy response is the most predictable thing in economics. But this isn’t going to start… tomorrow. It would take time… it would require a response. It would end up with Congress starting a committee to choose the color of paper to write reports on, to explain deflation and inflation to idiots who work there… The market could go down… And if deflation hits, look for lots of people to start loading up on mid-duration corporate bonds… But in the end, we have a strategy for when the time comes… When they print. They’ll always print. We’ll be headfirst into the Mag 7, the high F and Z score stocks, and likely distressed debt because that’s where returns will be fantastic. It’s not here yet, but the war-gaming is nearly done… We always prepare… Feel the BRRRR…. And stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

The Deflationary Scenario... Explored...

By -

February 15, 2026

0

Post a Comment

0Comments