| Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you. Dear Reader, This ad is sent on behalf of Paradigm Press, LLC, at 1001 Cathedral St., Baltimore, MD 21201. Today's editorial pick for you Why the Market Has No Confidence Ahead of PayPal's (PYPL) Earnings ReportPosted On Feb 02, 2026 by Joshua Enomoto PayPal (NASDAQ:PYPL) desperately needs a helping hand after years of underperformance. Unfortunately, if the positioning of smart money traders on PYPL stock has anything to say, investors could be in for a bumpy ride. For the most aggressive of speculators, there could be an opportunity here — but potentially to the downside. Table of ContentsOn Tuesday before the opening bell, PayPal is scheduled to release its fourth-quarter earnings report. Wall Street analysts are looking for earnings per share to hit $1.29 on revenue of $8.78 billion. In the year-ago quarter, EPS landed at $1.19 on revenue of $8.37 billion, beating the consensus targets of $1.12 and $8.28 billion, respectively. In recent history, PayPal has enjoyed a decent run. While it hasn't always beaten revenue expectations, when it does miss, the shortfall tends to be modest. However, the issue right now may be stagnation in the top line. For example, in 2022, year-over-year growth in the first quarter was over 13%. If PayPal hits its mark this time around, the growth would be just under 5%. It's no wonder, then, that PYPL stock has been struggling. Since the start of the year, the security slipped almost 10%. In the past 52 weeks, it's down more than 41%. Looking back in the past five years, the red ink metastasizes to over 80%. Of course, the reflexive vibe is that PYPL stock has fallen too much and that the security will eventually rerate higher. While this assumption is possible, we have to keep in mind that such sentiments are unearned; they're merely asserted by fiat. In fact, when we look at the smart money, this rerating argument clashes with the transactional geometry at hand. Volatility Skew Reveals the Underlying Sentiment for PayPal StockBefore diving into complex analyses, it's important to exhaust all first-order frameworks to establish the lay of the land. One of the most critical metrics is volatility skew, which identifies implied volatility (IV) or a stock's potential kinetic output across the strike price spectrum of a given expiration date. For the Feb. 20 options chain (which is a monthly option), volatility skew shows a pronounced half-smile, with both put-side and call-side IV curving upward across strike prices above the spot price. Further, put IV is materially higher than call IV, which has a very specific meaning. Effectively, the positioning indicates that smart money traders are mechanically short on PYPL stock, potentially to protect long-side exposure. This framework suggests that traders aren't necessarily panicked, but they are concerned that PayPal can disappoint in Q4, which isn't an unreasonable assumption given the deteriorating top line. On the lower strike price boundaries, put-side IV also stands above call-side IV. This trading dynamic indicates another type of downside protection: hedging against tail risk. Stated differently, the most sophisticated market participants realize that a sharp collapse of PYPL stock is a non-trivial possibility. Therefore, it may be prudent to consider far out-the-money (OTM) puts as insurance. It's important to point out that the areas of inflection do not necessarily indicate where derivative contracts are being bought. Instead, you can think of volatility skew as a surface-level distortion that bends according to holistic trading activity. To find out where PYPL stock is likely to land, we need the assistance of additional analytical frameworks. Establishing the Parameters of PayPal's BattlefieldWhile volatility skew may provide clues regarding smart money sentiment, we're still at a loss when determining the probabilistic outcome of PYPL stock. Fortunately, the first step is an easy one: consult the Black-Scholes-derived expected move calculator. In the case of the Feb. 20 options chain, the projected range is between $47.65 and $57.79, which represents a 9.62% high-low spread relative to the spot price. Where did this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this assumption, the aforementioned range represents where PYPL stock would symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration). Without getting into the math, Black-Scholes is saying that in 68% of cases, PYPL stock would land roughly between $48 and $58 when Feb. 20 rolls around. Although this is insightful because it lays out the parameters of the battlefield, it's not particularly helpful for retail debit-side traders. That's because we would have to cover every gap in this spectrum, which stands at over 21% ($57.79 divided by $47.65).  A major shortcoming of Black-Scholes is that it's only a first-order analysis. Essentially, the model is calculating its forward probabilities independent of structure, which explains why all expected move calculations are perfectly symmetrical. However, we know that probabilities in the stock market are asymmetrical; that is, forward probabilities are influenced by events immediately preceding the starting point. Almost certainly then, the probabilities calculated from Black-Scholes represent an initial reference; what we need is a second-order analysis, and that's where the Markov property comes into the frame. Diving into a Markovian Paradigm

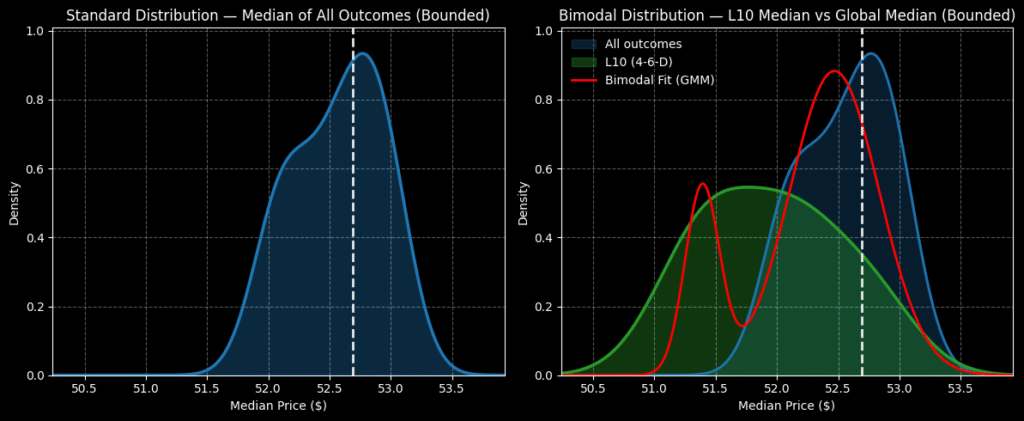

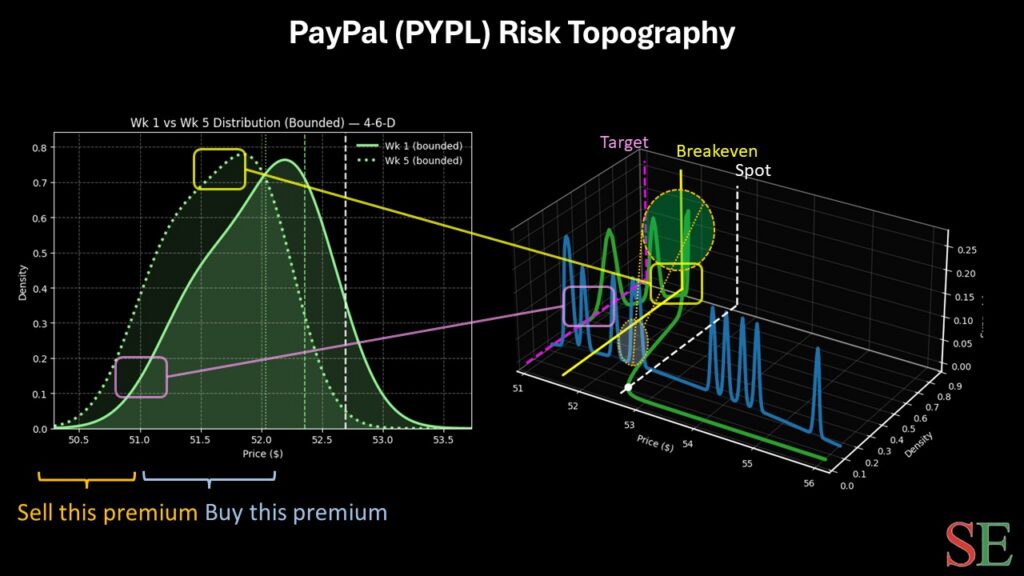

Primarily, the main difference between a Markov-inspired model and Black-Scholes is dependency. Markov frameworks explicitly condition forward probabilities based on the immediate structure of the system.  In the case of PYPL stock, it's entering the frame having printed only four up weeks out of the last 10 weeks. Under this 4-6-D condition, through a combination of enumerative induction and Bayesian-lite inference, we can estimate that PYPL over the next 10 weeks may land between $50 and $54. Further, probability density would likely peak between $51.20 and $52.50, thus indicating a distinctly bearish bias. What's more, over the next five weeks, the inferred outcome — using this proprietary Markov framework — would place PYPL stock between $50 and $53. In other words, there's a lot of downside risk, which is exactly why the smart money is hedged for volatility protection. For debit-side traders, probably the most realistic trade would be the 52.50/51.00 bear put spread expiring Feb. 20. If PayPal stock falls through the $51 strike price at expiration, the maximum payout would be nearly 81%. Breakeven lands at $51.67, which is very close to peak probability density, thereby elevating the trade's probabilistic credibility. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

🚨 [BREAKING] Trump’s New AI Executive Orders Just Leaked?

By -

February 09, 2026

0

Post a Comment

0Comments