Watch this video to get a full update on the economy this weekend! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

| Hey there, it’s Micah here… I hope you’re having a great Saturday. Today I wanted to share some insightful analysis from my friend and mentor, Andy Fetter. We recently held a Lecture covering some of the most important economic signals that tend to forecast recessions. Andy also shared an update on the AI Landscape. 👉🏼Click HERE to Watch Some of the highlights include Andy’s comments on construction payroll which is currently humming along. This is a signal that construction workers are nearly fully employed. For a recession to happen this index would need to drop considerably.

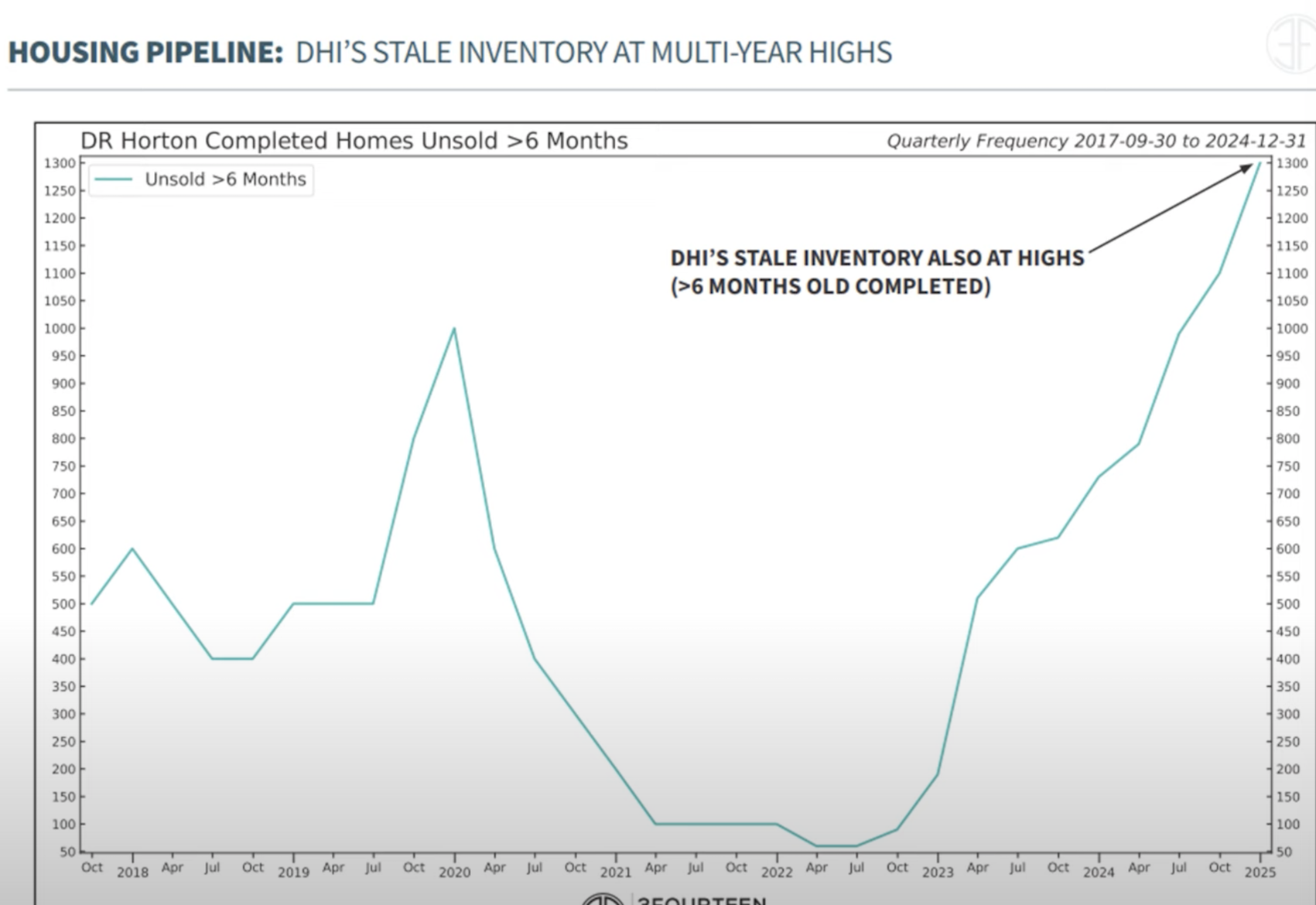

The canary in the coal mine - Housing Inventory

On the flip side of construction employment is housing inventory. Here’s a chart showing one of the biggest home builders. Notice their inventory is at all time highs. Could this signal a potential slowdown in construction?

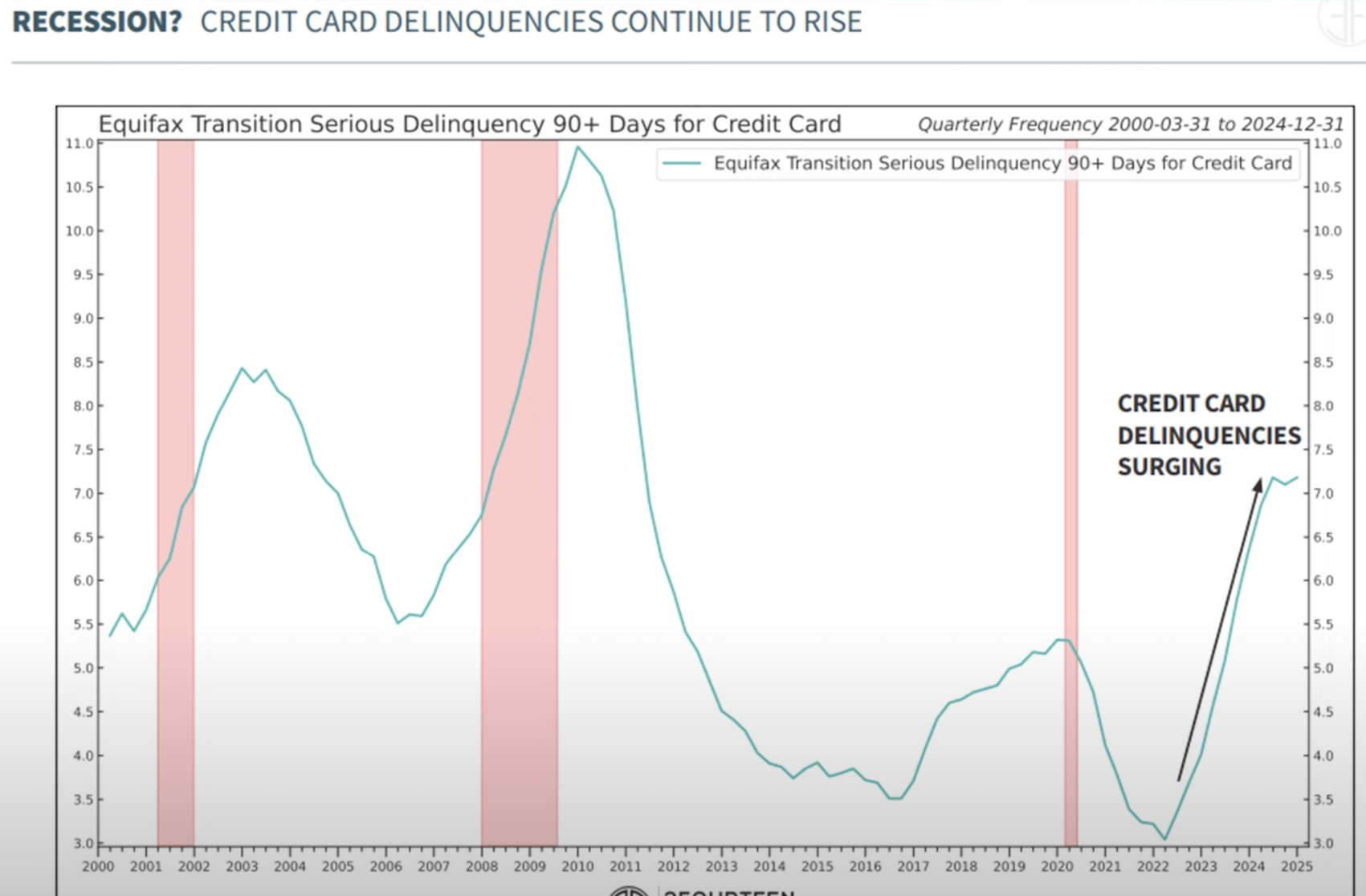

Also, a chart to note is credit card delinquencies. We’re seeing these at multi year highs. Could this be an early signal for an upcoming recession?

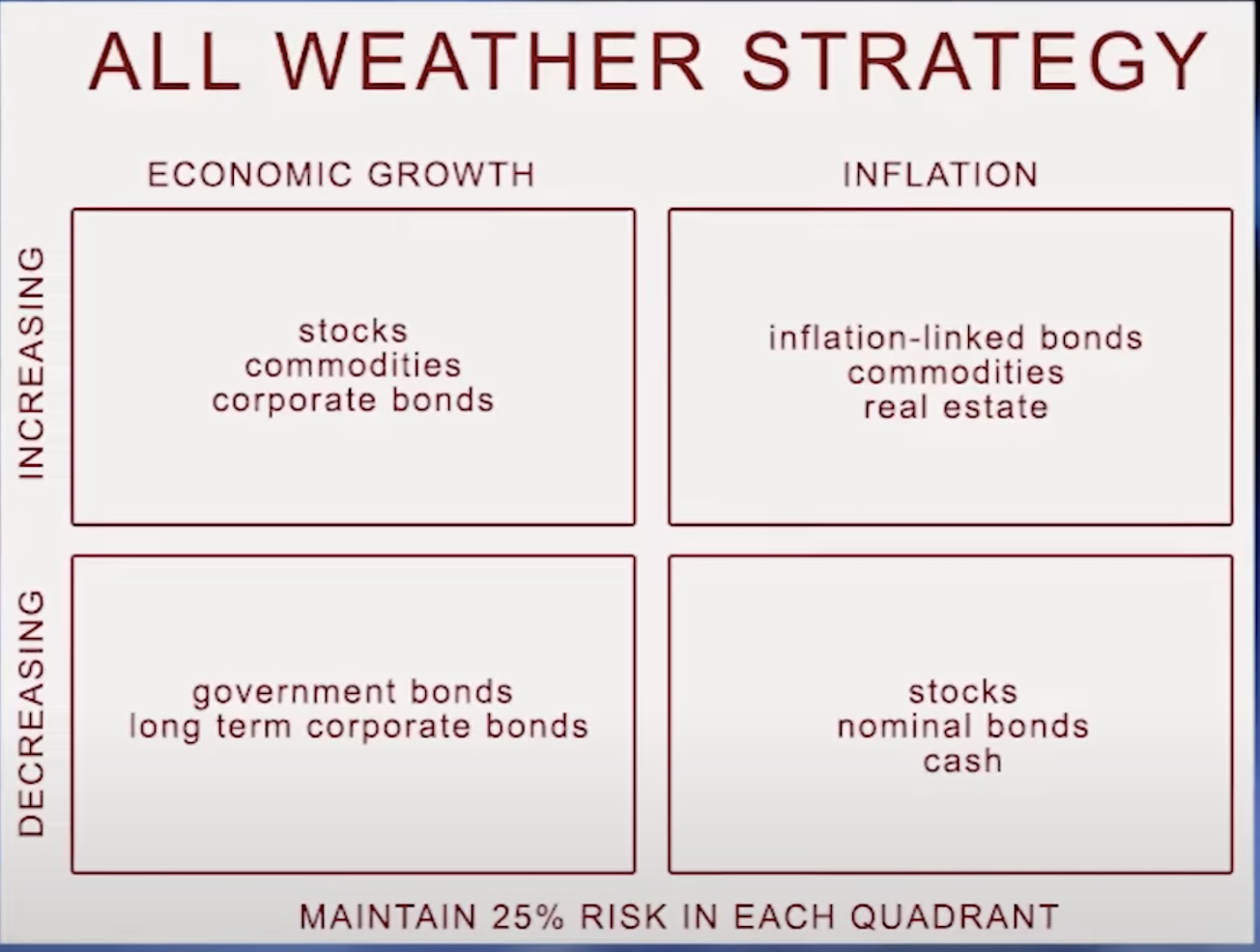

As part of the lecture Andy touched on how to create an “All Weather Strategy”.

Andy wrapped up the lecture by doing a wonderful review of the current AI Landscape. Things are moving so quickly here it was great to get an up to date picture of trends and investable opportunities. 👉🏼Check out the replay here. I’ll leave it up this weekend for you to watch. Hope you enjoy it. Trade On,

Micah

Micah Lamar

CEO WallStreet.io

Micah@WallStreet.io Questions? Please email us at Support@WallStreet.io or Chat with us 1-on-1 at WallStreet.io WallStreet.io All Rights Reserved © 2024 Manage Email Notifications Thank you for being a part of our community. Please use the social links below and spread the word. We appreciate you! Thanks in advance. |

Post a Comment

0Comments