| | | | | | | Presented By Yieldstreet | | | | Axios Markets | | By Sam Ro ·Aug 06, 2021 | | Today's newsletter is 1,191 words, 4.5 minutes. Situational awareness: The July U.S. jobs report will be released at 8:30am ET. | | | | | | 1 big thing: No construction boom in houses of worship |  Data: U.S. Census Bureau, FRED; Chart: Axios Visuals Construction spending in the U.S. has risen steadily since the financial crisis, and as of June sat at a near-record annualized rate of $1.55 trillion. Delving into the data, the dollars spent in most categories of construction grew along with the overall economic expansion. - But one segment bucks the trend most noticeably. Construction of religious facilities has fallen sharply over the past two decades.

Why it matters: Construction spending provides insights into the economic growth of the U.S., and about what Americans are investing in. - Similar to how the decline of brick and mortar retail stores doesn't necessarily reflect an outright decline in shopping, the way people worship is also evolving.

By the numbers: Construction spending on religious facilities touched a record low annualized rate of $3 billion in June. This is a 66% decline from its $8.8 billion record high in August 2003, according to Census data. - Meanwhile, construction spending on amusement and recreation facilities surged 42% from $7.7 billion in August 2003 to $10.9 billion as of June.

- Educational buildings, office space, and sewage and waste facilities are among the categories with rising spend in recent years.

Details: Religious facilities in the dataset include houses of worship such as churches, mosques, synagogues and temples. They do not include certain buildings owned by religious organizations like college facilities and hospitals. Between the lines: According to Gallup, just 47% of U.S. adults said they were a member of a church, synagogue or mosque in 2020. This was the first time ever this group wasn't the majority. Yes, but: Rev. David Schoen, a minister for the United Church of Christ Church Building & Loan Fund, follows church closures closely and tells Axios that the decline in construction doesn't tell the whole story. - Schoen notes that worshippers are engaging in other ways, like through online portals. They're also meeting in schools and warehouses.

- "There's a number of churches on the market that can be bought," Schoen adds. "So there's not a whole lot of new construction."

What to watch: "Millennials have been a little later in terms of partnering and having children and moving to the suburbs," Kermit Baker, chief economist for The American Institute of Architects, tells Axios. - "I think all that sort of feeds into the decision to get affiliated with a religious organization."

- Baker doesn't think trends will reverse as millennials get older, but says maybe they "begin to stabilize."

The bottom line: Religious construction is a small part of the overall picture. But category trends provide insight into why aggregate measures of data are going up or down. |     | | | | | | 2. Catch up quick | | The Congressional Budget Office says the $1 trillion infrastructure bill will add $256 billion to deficits over 10 years. (WSJ) Minneapolis Fed president Neel Kashkari warns that the Delta variant presents a risk to the labor market recovery. (Reuters) Didi Global is considering giving up control of its data in an effort to appease Chinese regulators. (Bloomberg) |     | | | | | | 3. Wall Street pros are upping their forecasts |  | | | Illustration: Sarah Grillo/Axios | | | | Within the span of a week, three of Wall Street's most prominent forecasters have told clients the stock market is heading higher than they previously thought. Why it matters: A lot of people look to these folks for guidance. Not just clients, but also the investors who read the media coverage of this research. - Since the beginning of the year when these strategists initially published their year-end targets for the S&P 500, the index has gone from 3,756 to 4,429 as of Thursday, a gain of 18%.

- Their calls come at a time when markets are trading near all-time highs, leaving investors wondering if this is a peak or if things will keep going up from here.

By the numbers: On Thursday, Goldman Sachs' David Kostin raised his year-end S&P 500 target to 4,700 from 4,300. He raised his earnings per share estimate to $207 from $193, acknowledging that companies have been more profitable than he had anticipated. - Oppenheimer's John Stoltzfus raised his target to 4,700 from 4,300 three days earlier. He raised his EPS estimate to $196 from $175, noting that revenue and earnings have held up impressively despite the spread of COVID-19 variants and ongoing supply chain issues.

- Deutsche Bank's Binky Chadha offered a less rosy assessment when raising his target to 4,500 from 4,100 last Friday.

- "We continue to look for a notable correction as macro growth peaks," Chadha warned. Though he raised his EPS estimate to $210 from $202, making him the most bullish of the group from a profitability perspective.

What they're saying: "As long as I have been in the business, the end of 2Q EPS season has been the time of the year the sell-side initiates EPS and targets for next year and tweaks their second-half numbers as well," Real Money columnist Helene Meisler tells Axios. - "So mostly I think, 'Sure, it sounds like they are getting bullish near the highs,'" she says. "But I think it's actually quite a seasonal thing they do."

The bottom line: Not even the most sophisticated, well-resourced, full-time equity strategists can predict with precision where the stock market is heading over the next year. |     | | | | | | A message from Yieldstreet | | How to diversify your portfolio like the ultra-wealthy | | |  | | | | You can diversify your investment portfolio while generating passive income with Yieldstreet. Here's how: The platform lets savvy investors go beyond crypto and the stock market, giving them access to alternative investments such as art, real estate and more. Put your money to work. | | | | | | 4. Inflation curiosity peaked in May |  Data: Google; Chart: Axios Visuals Google searches for "inflation" and "hyperinflation" are running at less than a fifth of their early-May highs, Axios Capital author Felix Salmon writes. Why it matters: Worry about inflation can be a good thing, economically, if it brings forward spending that would otherwise have been delayed. But it can also become self-fulfilling, at least in theory. The big picture: It's been so long that inflation was a real problem that you can forgive Americans for wanting to look it up. The bottom line: Searches on "inflation" are driven more by media handwringing than they are by actual retail prices. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Small businesses seek better applicants |  Data: NFIB; Chart: Axios Visuals Small businesses aren't happy with who's applying for their open jobs. Driving the news: According to the NFIB's July Small Business Jobs Report, "labor quality" is the top overall biggest concern, with 26% of survey respondents identifying it as their "single most important problem." Why it matters: Companies everywhere are struggling to find workers to fill open positions. And despite many employers raising wages to attract talent, these hiring issues persist. Go deeper: Of those surveyed, 63% said they were currently hiring or trying to hire. Of this group, 89% said there were few or no "qualified job applicants." - Meanwhile, a record high net 39% said they increased pay. And a net 26% said they planned to increase pay within the next month.

- A modest 8% citied "labor cost" as their top problem.

Between the lines: You might think that if labor cost isn't a top problem, then the solution is for employers to raise pay endlessly until those qualified applicants come. - But as ADP chief economist Nela Richardson recently explained to Axios, raising pay for new applicants often means having to raise pay for existing employees, which is costly.

- Also, raising pay now gives employers less flexibility down the road as employers would rather avoid having to cut pay down the road.

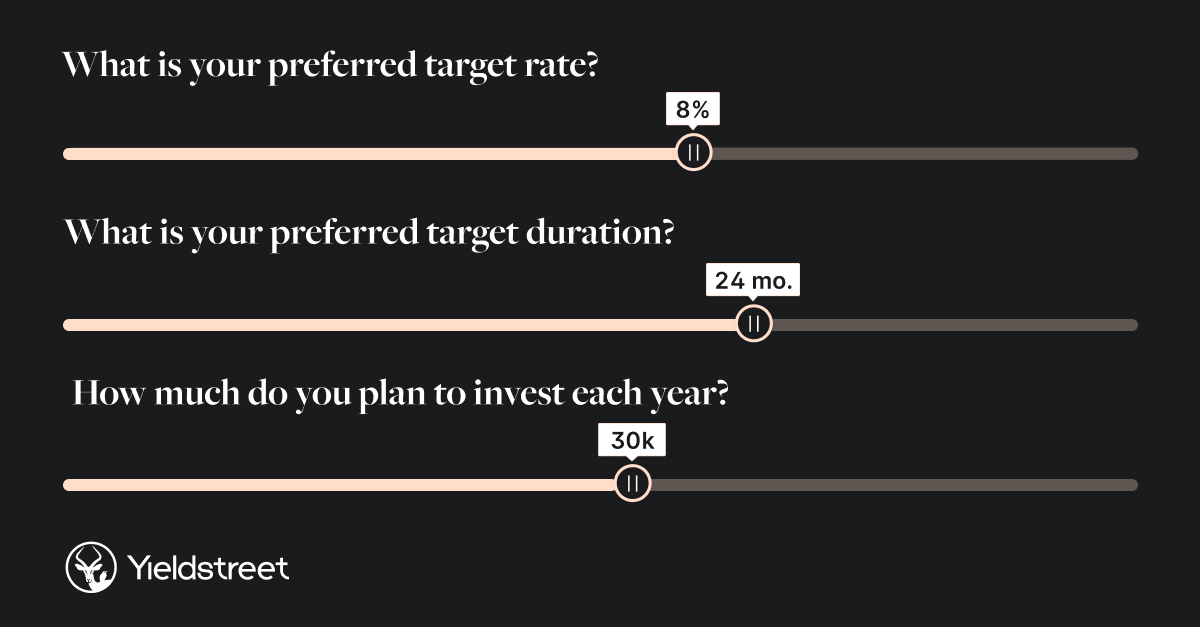

What to watch: The July U.S. employment report comes out today and will provide the latest update on what industries are hiring and how much employers are having to raise wages to fill those roles. |     | | | | | | A message from Yieldstreet | | Now you can invest like the ultra-wealthy | | |  | | | | Yieldstreet, an alternative investment platform, has returned over $1 billion in principal and interest to investors to date. More info: Their deals typically have short durations — three months to five years — and target annual yields of 3-15%. Join 300,000+ members today. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

Post a Comment

0Comments