| Trading plan for EUR/USD on December 10. Global COVID-19 incidence is again at highs. The euro pierced the lower border of 1.2078. 2020-12-10

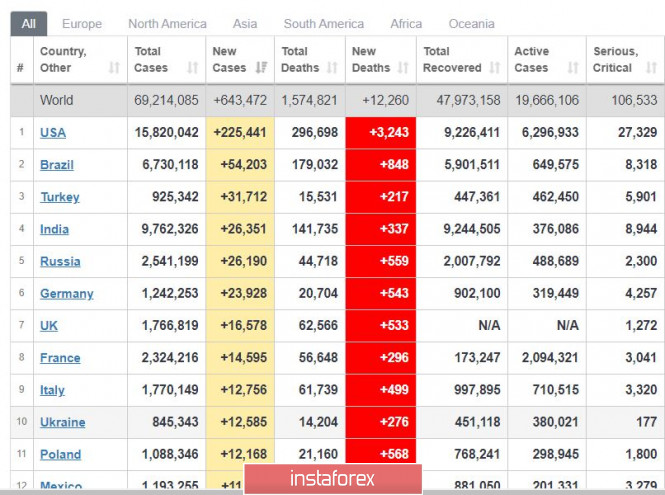

Latest data indicates that global COVID-19 incidence has increased again. The world recorded a total of 643,000 new cases yesterday, only 40,000 short of its peak which was 680,000. In the United States, morbidity has risen to more than 200,000, while Brazil recorded a new growth to 54,000. At the same time, mortality rate is also at high levels. The world recorded above 12 thousand deaths yesterday, where 3.2 thousand of it came from the US. Europe also observed growth in cases, so the authorities may impose stronger quarantine measures at Christmas. On a positive note, vaccinations start in the UK tomorrow, December 11. Meanwhile, Pfizer's vaccine may be approved in the US today.

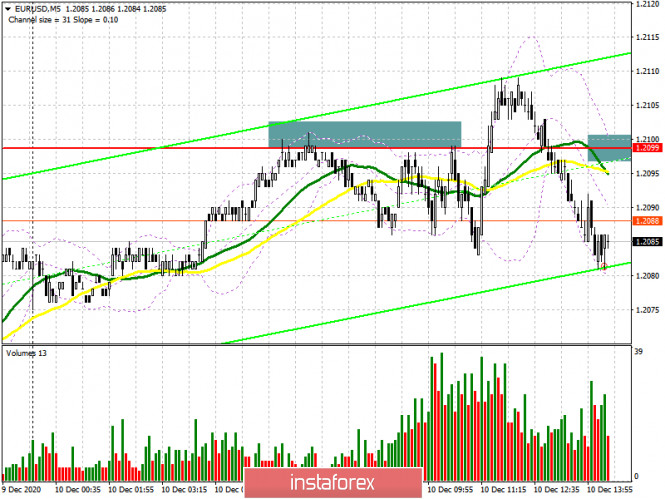

EUR/USD - the euro pierced the lower border of 1.2078 yesterday. Nonetheless, the trend still looks upward. Open long positions from 1.2150. Open short positions from 1.2058. At 14:30, important news from the ECB and US employment will be released. Trading idea for gold 2020-12-10  As you've probably already seen in many analytical reviews, most analysts recommend buying gold, and this generally looks logical amid the current global crisis. However, we must remember that we are traders not investors, and we need to make money in both short and medium terms and it is not important in which direction. Today, there is such an opportunity. Since the beginning of this week, gold has been trading rather interestingly, having a very clear lower limit at 1822. We can use this level to pull the price down and gain profit.  So, since the quotes have formed three wave patterns (ABC) where wave A is yesterday's short initiative, we can work for a 50% retracement, from 1845 to 1821. Such a transaction has a 1: 1 risk / profit ratio, and will be relevant until the quote breaks out of 1866. Of course, you still need to be careful since this financial market is very precarious. But, it will give plenty of profit provided that you use the right approach. Good luck! Analysis of GBP/USD on December 10. Ursula von der Leyen and Boris Johnson's talks have failed 2020-12-10

In the most global terms, the construction of an upward trend continues, even though the quotes are moving away from the previously reached highs. Moreover, at the moment, the wave pattern looks convincing enough to be considered complete. Five waves are built up as part of a non-impulse section of the trend. The attempt to break the maximum of the previous global wave Z was unsuccessful. Thus, now the markets can start selling the British dollar, which has been brewing for a long time.

On the lower chart, the same chart shows a departure of quotes from the previously reached highs, however, the entire wave marking of the upward trend section may once again become more complicated and take an even longer form. Despite the lack of positive news about Brexit, markets are in no hurry to get rid of the British currency. Thus, everything may even end up with just three small waves building down, after which the construction of the upward trend section will resume. Although with the current news background, this is hard to believe. The negotiating teams of Michel Barnier and David Frost took a short break, and Boris Johnson and Ursula von der Leyen discussed the deal instead. However, the President of the European Commission and the British Prime Minister failed to show greater effectiveness than Barnier and Frost. After the meeting was over, both sides made a statement that no progress had been made and the differences remained very serious. And then there was information that Johnson and Leyen also decided to allow time until Sunday for the negotiating delegations to try to break the deadlock. Many analysts are already calling the whole process a pun. Every two or three days, the parties report a lack of progress, talk about a catastrophic lack of time, and extend the negotiations for several more days. What's the point? When will London and Brussels simply announce that they failed to reach an agreement? "Our friends in the EU insist that they have the right to punish us or take retaliatory measures if they adopt a new law in the future, and we in our country do not comply with it or do not adopt the same one. They are demanding that Britain is the only country in the world that does not have sovereign rights over their fishing grounds. I think no Prime Minister of our country would agree to such conditions," Boris Johnson said. So, given the nature of the disagreement, I believe that a deal cannot be reached in principle. London wants to maintain access to the European market as if the UK remained in the EU, which in itself sounds absurd. But it does not want to make concessions to maintain access to the huge European market. The differences are insurmountable. General conclusions and recommendations: The pound/dollar instrument presumably completed the construction of an upward trend section. Thus, now I recommend looking closely at the sales of the tool. The Briton will probably be aiming for the 29th figure now. I expect to build at least three wave formations for this purpose. Thus, at this time, I recommend selling the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866. A successful attempt to break through the 0.0% Fibonacci level will indicate a new complication of the upward trend section and cancel the sales option. EUR/USD: plan for the American session on December 10 (analysis of morning deals) 2020-12-10 To open long positions on EURUSD, you need: In my morning forecast, I paid attention to the level of 1.2099 and recommended making a decision from it. If you look at the 5-minute chart, you will see that the unsuccessful attempt of the bulls to break above this range and return to this level formed a good sell signal, which is still working at the moment. Several tests of the level of 1.2099 from the bottom up during the European session were good points for opening short positions. So far, the movement has been no more than 15 points, however, this is enough to move stop orders to this level, especially given the low volatility observed before the publication of the European Central Bank's decision on interest rates.

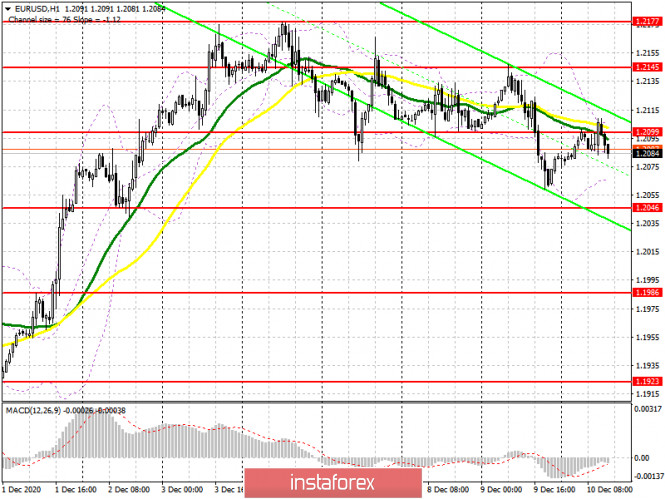

From a technical point of view, nothing has changed. Everyone is waiting for the results of the meeting of the European regulator, on which the further direction of EUR/USD depends. Buyers of the European currency need to try to regain the position of the market. The initial task remains to break through and consolidate above the resistance of 1.2099. Only a test of this level over and down after the breakdown forms a good signal to open long positions in the expectation of continuing the upward trend, faith in which ends every minute. If the upward trend resumes, the next target will be a return to the resistance of 1.2145, and then a test of last week's high in the area of 1.2177, where I recommend taking the profits. Only a break of 1.2177 will lead to the continuation of EUR/USD growth to the area of highs of 1.2255 and 1.2339. However, this will happen in the future, however, it will only happen if the European Central Bank does not make serious changes to monetary policy at its meeting. If the euro declines in the second half of the day, only the formation of a false breakout in the support area of 1.2046 will be a signal to open long positions. I recommend buying the pair immediately for a rebound only from the level of 1.1986, based on a correction of 20-25 points within the day. A test of this low will lead to a reversal of the uptrend in the short term. To open short positions on EURUSD, you need to: At the moment, sellers of the pound are focused on protecting the level of 1.2099, and as long as trading is conducted below this range, the pressure on the euro will remain. The next formation of a false breakout at this level after the publication of the decision of the European Central Bank will be a signal to open short positions in the continuation of the downward correction to the area of the minimum of 1.2046, below which it was not possible to break yesterday. Fixing this range with a test of it from the bottom up will be a good signal to sell EUR/USD already in the area of new weekly lows of 1.1986 and 1.1923, which will completely cancel out buyers' hopes for a continuation of the bull market by the end of this year. However, such a large fall in the euro will occur only if the European Central Bank goes beyond the expectations of investors and expands the bond purchase program much more. Also, we should not exclude hints from the President of the European Central Bank about the option of introducing negative interest rates in the Eurozone next year to stabilize inflationary pressure, which is seriously suffering due to the sharp growth of the euro. If EUR/USD rises above the resistance of 1.2099, it is better not to rush into sales. In this scenario, you can only count on short positions from the level of 1.2145 or sell EUR/USD from the new maximum in the area of 1.2177 with the aim of a downward correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for December 1 recorded an increase in long and a reduction in short positions. Buyers of risky assets believe in the continuation of the bull market, and in the further growth of the euro after breaking the psychological mark in the area of the 20th figure. For example, long non-profit positions rose from 206,354 to 207,302, while short non-profit positions fell to 67,407 from 68,104. The total non-profit net position rose to 139,894 from 138,250 a week earlier. It is worth paying attention to the growth of the delta, observed for the second week in a row, after its 8-week decline, which indicates a clear advantage for buyers and a possible resumption of the medium-term upward trend for the euro. It will be possible to talk about a larger recovery only after European leaders agree with the UK on a new trade agreement. However, we did not get any good news last week, and we have an EU summit ahead of us, which will put the final point in this story. The euro will be supported by news about the lifting of restrictive measures for the Christmas holidays, as well as the absence of major changes in the monetary policy of the European Central Bank. Signals of indicators: Moving averages Trading is conducted around 30 and 50 daily moving averages, which indicates the sideways nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower limit of the indicator around 1.2065 will lead to a larger decline in the pound. A break of the upper limit of the indicator in the area of 1.2110 will lead to an upward trend of the pair. Description of indicators - Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

Author's today's articles: Mihail Makarov  - - Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Alexander Dneprovskiy  Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst. Graduated from Kiev State University of Economics. On Forex market since 2007. Started his work at Forex as a trader. Since 2008 is working as a currency analyst. Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Post a Comment

0Comments