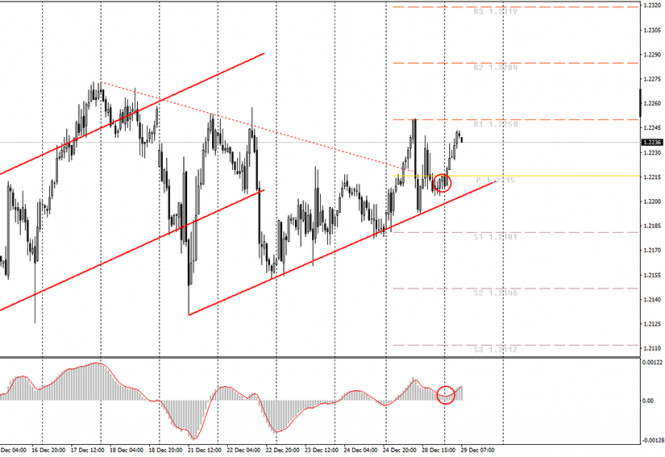

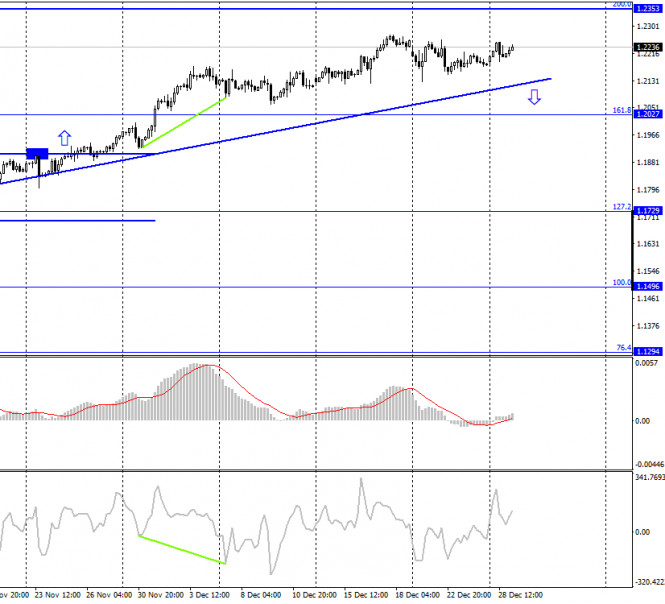

| Indicator analysis. Daily review on the EUR/USD currency pair for December 29, 2020 2020-12-29 Yesterday, the pair unexpectedly worked out the low (35 points) on the news, but then the trend took its toll, and the daily candle closed with a white candle, remaining below the historical resistance level of 1.2234 (blue dotted line). Today, the price may continue to move up. As per the economic calendar, news is not expected on Tuesday. Trend analysis (Fig. 1). On Tuesday, the market from the level of 1.2215 (closing of yesterday's daily candle), in the morning will try to continue the upward movement with the target of 1.2277, which is the retracement level of 85.4% (yellow dotted line). Upon testing this level, the price may continue to move up with the target of 1.2348 - the upper limit of the indicator Bollinger bands (dotted black line).

Figure 1 (Daily Chart). Comprehensive analysis: - Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - up;

- Trend analysis - up;

- Bollinger bands - up;

- Weekly chart - up.

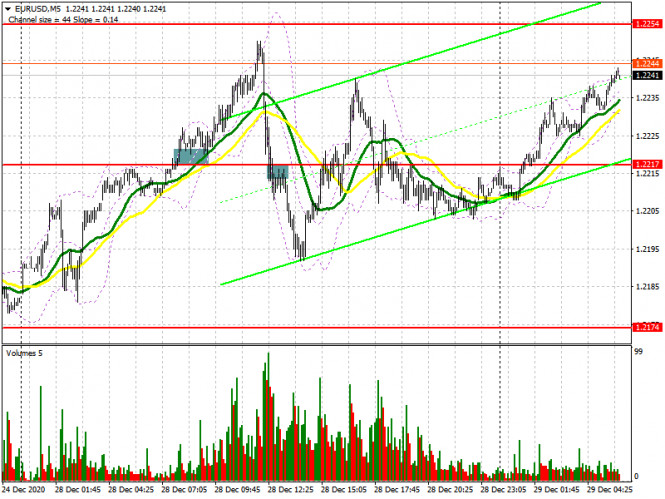

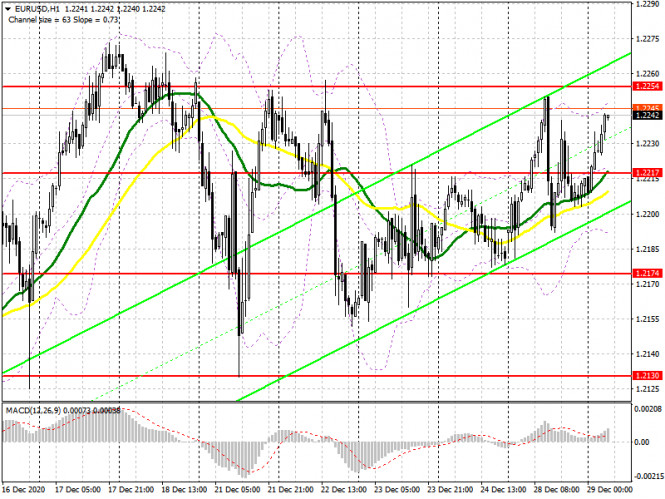

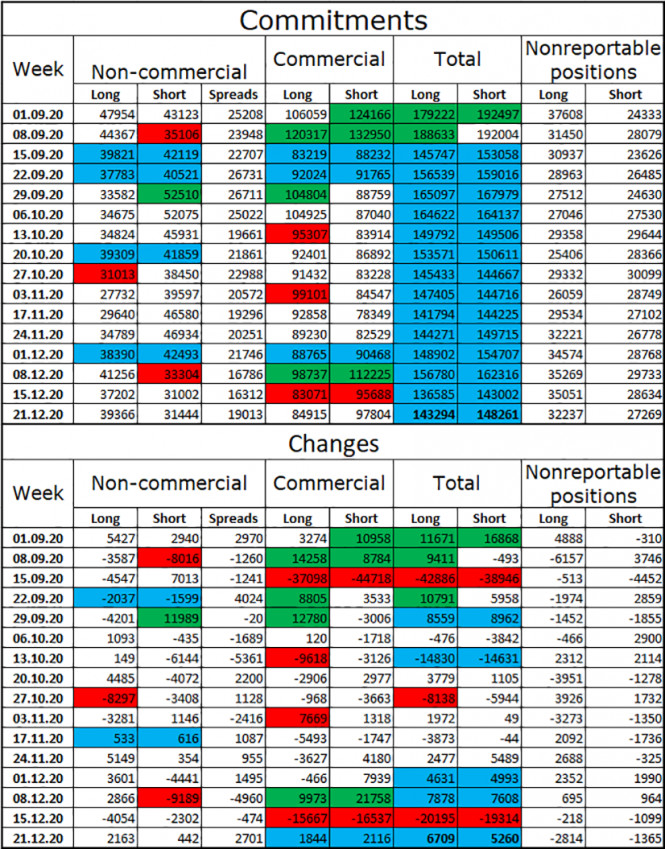

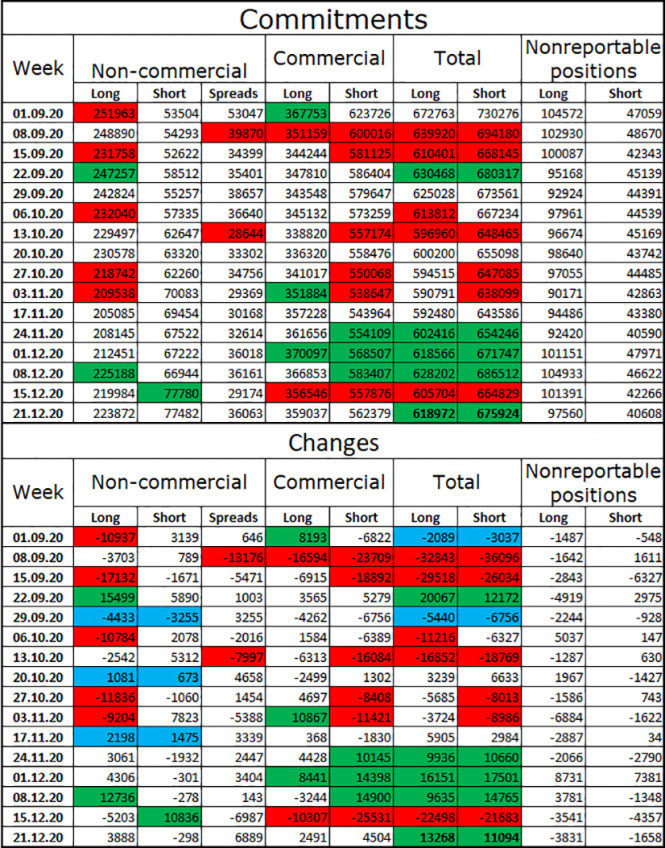

General conclusion: Today, the price from the level of 1.2215 (closing of yesterday's daily candle), in the morning will try to continue the upward movement with the target of 1.2277, which is the retracement level of 85.4% (yellow dotted line). Upon testing this level, the price may continue to move up with the target of 1.2348 - the upper limit of the indicator Bollinger bands (dotted black line). Unlikely scenario: When moving upward, after reaching the pullback level of 85.4% - 1.2277 (yellow dotted line), a downward movement is possible with the target of 1.2117 - a pullback level of 14.6% (red dotted line). EUR/USD: plan for the European session on December 29. COT reports. Euro buyers not giving up, ready to fight for new annual highs. Aiming for 1.2254 2020-12-29 To open long positions on EUR/USD, you need: Several rather interesting signals to enter the market appeared yesterday. Let's take a look at the 5-minute chart and break down the entry points. Bulls are confidently getting the pair to settle above 1.2218 in the first half of the day, and amid the absence of important fundamental reports, they are gradually pushing the euro to the resistance of 1.2254. Testing the 1.2218 level from top to bottom became a signal to open long positions. However, we were literally 4 points short from updating the 1.2254 level. In general, growth in the first half of the day was quite good. After the pair returned and settled below support at 1.2217 during the US session, it was tested from the bottom up, which resulted in creating a sell signal. However, the euro did not significantly fall, and the overall decline was around 25 points. I marked all entry points on the chart. But, before talking about the succeeding prospects for the pair's movement, let's see what happened in the futures market and how the Commitment of Traders (COT) positions changed. Judging by the latest figures, many buyers of the euro have gradually built up long positions, but with more cautious optimism. A less significant increase in the delta occurred due to the fact that sellers also show themselves in the market, who, with each update of the next annual high, raise their short positions. An increase in both short and long positions were recorded in the COT report for December 21. Buyers of risky assets continue to believe in a bull market amid news that vaccination against the first strain of coronavirus has begun in Europe. However, due to the quarantine measures taken after the detection of a new strain of Covid-19 that appeared recently in the UK, there are still quite a few problems. Thus, long non-commercial positions rose from 218,710 to 222,443, while short non-commercial positions jumped from 76,877 to 78,541. The total non-commercial net position rose from 141,833 to 143,902 a week earlier. Delta growth has resumed, but is unlikely to continue at the end of this year, as trading volume will be rather low. Therefore, you should not count on the euro's rapid growth this week, although the low trading volume may lead to a surge in volatility.

Now for the technical picture. Larger players will continue to focus on defending support at 1.2217. Forming a false breakout there in the first half of the day will lead to creating a signal to open long positions in the euro. However, given the lack of important fundamental statistics and the low trading volume in the final week before the new year, one can not count on serious activity in the 1.2217 area. If there isn't much activity in the 1.2217 area, I recommend postponing long positions until the larger support level of 1.2174 has been updated, or buy EUR/USD immediately after rebounding from last week's low in the 1.2130 area, counting on a correction of 20-25 points within the day. We can say that euro buyers managed to bring back the upward trend only when the pair has surpassed and settled above resistance of 1.2254. However, testing this level from top to bottom, similar to yesterday's long deals, which I analyzed above, creates an additional signal to open long positions in euros and by also updating highs of 1.2304 and 1.2339, where I recommend taking profits. To open short positions on EUR/USD, you need: Sellers will actively defend resistance at 1.2254, just above which the annual highs pass. Forming a false breakout there will lead to creating a new downward correction, which aims to get the pair to return to support at 1.2217, which is now the middle of the horizontal channel. Getting the pair to settle below this range and testing it from the bottom up will pave the way to a low of 1.2174, where I recommend taking profits. The absence of important fundamental statistics will also affect today's trading volume, so volatility can be quite unpredictable. The succeeding target will be 1.2130, testing it will mean a reversal of the current upward trend. If the bulls find strength and manage to surpass the resistance of 1.2254, I recommend not to rush to sell. The optimal scenario would be a test of the 1.2304 high, from where you can sell EUR/USD immediately on a rebound, counting on the pair's correction down by 20-25 points.

Indicator signals: Moving averages Trading is carried out slightly above 30 and 50 moving averages, which indicates that euro buyers are in control of the market. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator around 1.2254 will lead to a new wave of growth. In case the pair falls, support will be provided by the lower border of the indicator in the 1.2195 area. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

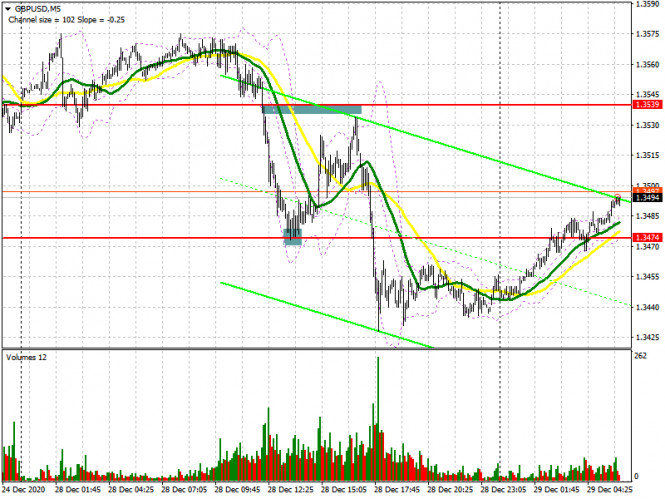

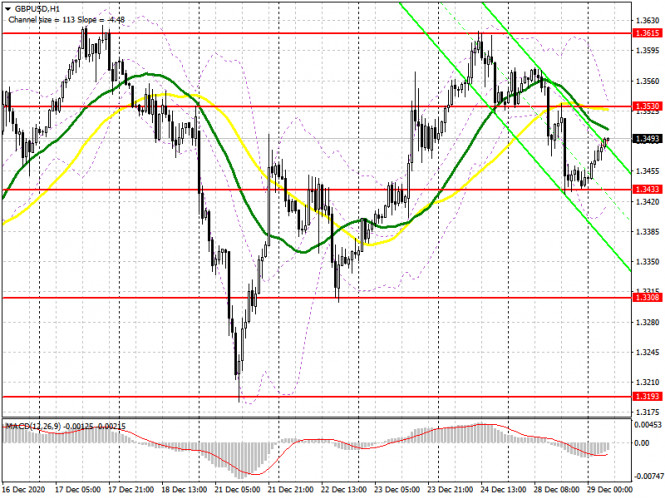

GBP/USD: plan for the European session on December 29. COT reports. Pound falls due to lack of new benchmarks 2020-12-29 To open long positions on GBP/USD, you need: If you recall yesterday's afternoon forecast, I mentioned that it is necessary to open long positions from the 1.3474 level, which happened. Let's take a look at the 5-minute chart. We can see how the bears pulled down the pair after surpassing support at 1.3539, which exactly leads to the 1.3474 level, where after a false breakout, an excellent signal to open long positions was created, as a result of which the pair returned to support at 1.3539. A couple of points were missing before this level was tested from the bottom up, therefore, as in the first half of the day, I was forced to miss this sell signal, which turned out to be quite profitable since that the pair immediately collapsed by 80 points right after. Before analysing the technical picture, let's take a look at what happened in the futures market last week. The demand for the pound remains, even considering that at the time when this report was released, the signing of a trade agreement between the UK and the EU was not yet announced. The Commitment of Traders (COT) reports for December 21 recorded an increase in interest in the British pound, both among buyers and sellers. Long non-commercial positions increased from 35,128 to 37,550. At the same time, short non-commercial remained practically unchanged and increased only from 31,060 to 31,518. As a result, the non-commercial net position remained positive and grew to 6,032, against 4,068 a week earlier. All this suggests that traders continue to bet on the pound's growth, even in the face of the new Covid-19 strain, which was first reported in the UK. Everyone believes in the vaccine and that the beginning of next year, as soon as the quarantine measures are lifted, will be associated with strong economic growth, which will give the market a new bullish impetus and cause the pound to update new annual highs. Additional stimulus from the Bank of England may somewhat smooth out the upward trend in the pound, but it may not be there, since the trade agreement with the EU was concluded at the very last moment.

As for the technical picture, the pound slightly recovered during the Asian session and it may continue at the beginning of the European session. Buyers must maintain control over the 1.3433 level in the first half of the day. Forming a false breakout will be a signal to open long positions in sustaining the pound's recovery in the short term and for it to reach the resistance of 1.3530. The main goal will be to surpass this level and settle. Testing this level from top to bottom creates an additional entry point into long positions in hopes to reach a high of 1.3615, which is where the pair fell yesterday. The succeeding targets are still resistances 1.3690 and 1.3750, but they will be available only if excessive volatility appears amid low trading volume on the pre-New Year days. In case the pound falls and bulls are not active in the support area of 1.3433, it is best not to rush to buy, but wait for an update of the 1.3308 low, from which you can buy GBP/USD immediately on a rebound, counting on a correction of 30-40 points within the day. To open short positions on GBP/USD, you need: The lack of important fundamentals earlier this week will continue to exert some pressure on investors who are taking profits after the lack of major gains expected from the signing of the UK-EU trade deal. Forming a false breakout in the resistance area of 1.3530 will return pressure to the pair and result in a decline and a test of yesterday's support at 1.3433. Only a real breakout of this level and being able to test it from the bottom up, creates a good signal to open short positions in GBP/USD, in hopes for the pair to fall to lows of 1.3308 and 1.3193, on which the succeeding bear market depends on. Such high volatility at the end of the year should not be ruled out, especially given the low trading volume. If the bulls manage to recapture the 1.3530 level in the morning, then it is better not to rush with short positions. The optimal scenario for selling the pound would be failure to settle above 1.3615. I recommend opening short positions immediately on a rebound from the high of 1.3690, counting on a downward correction of 30-35 points within the day.

Indicator signals: Moving averages Trading is carried out below 30 and 50 moving averages, which indicates the pound's succeeding decline in the short term. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator in the 1.3530 area will lead to a new wave of growth for the pound. A breakout of the lower border of the indicator around 1.3430 will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

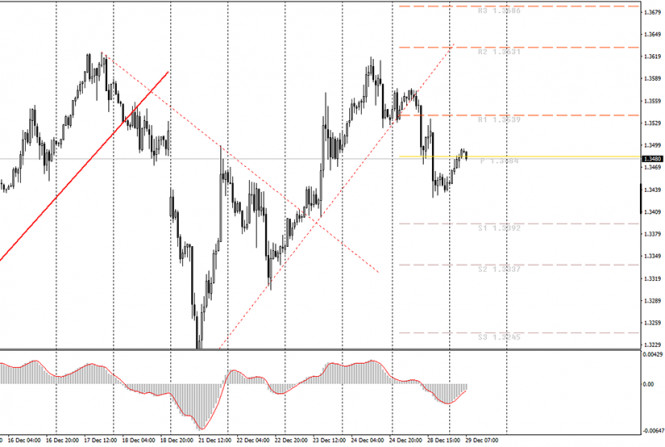

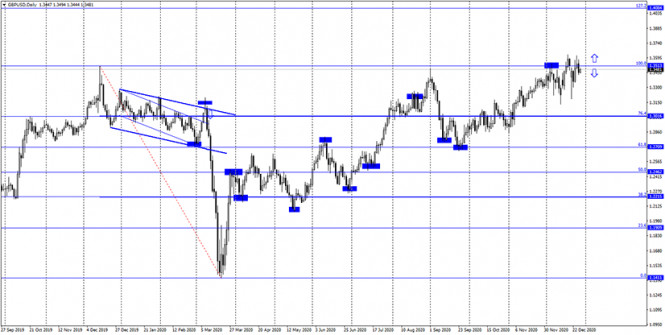

Indicator analysis. Daily review for the GBP/USD currency pair on 29/12/2020 2020-12-29 Trend analysis (Figure 1). Today, from the level of 1.3445 (the closing of yesterday's daily candle), the market will try to continue moving up with the target of 1.3481 which is the historical resistance level (blue dotted line). If this level is reached, work up with the target of 1.3622 upper fractal (red dotted line).  Figure 1 (daily chart). Comprehensive Analysis: - Indicator Analysis – up

- Fibonacci Levels – up

- Volumes – up

- Candle Analysis – up

- Trend Analysis – up

- Bollinger Bands – up

- Weekly Chart – up

General Conclusion: Today, from the level of 1.3445 (the closing of yesterday's daily candle), the price will try to continue moving up with the target of 1.3481 which is the historical resistance level (blue dotted line). If this level is reached, work up with the target of 1.3622 upper fractal (red dotted line). Alternative Scenario: From the level of 1.3445 (the closing of yesterday's daily candle), the price will try to continue moving up with the target of 1.3481 which is the historical resistance level (blue dotted line). If this level is reached, work down with the target of 1.3299 which is a rollback level of 14.6% (red dotted line). Technical Analysis of GBP/USD for December 29, 2020 2020-12-29 Technical Market Outlook: The GBP/USD pair has failed to break through the recent swing high seen at the level of 1.3624 and pulled-back towards the middle of the consolidation zone. The local low during the pull-back was made at the level of 1.3428 and will now act as an intraday support. Nevertheless, the bullish pressure is clear and if the swing high is broken, then the next target is seen at the level of 1.3667 and 1.3708. Please notice, the market conditions are now overbought, so a pull back towards the intraday support located at 1.3515 and 1.3538 is welcome. The momentum remains strong and positive, which supports the short term bullish outlook. Weekly Pivot Points: WR3 - 1.4170 WR2 - 1.3890 WR1 - 1.3745 Weekly Pivot - 1.3458 WS1 - 1.3319 WS2 - 1.3039 WS3 - 1.2880 Trading Recommendations: The GBP/USD pair might have started a long term up trend and the trigger for this trend was the breakout above the level or 1.3518 on the weekly time frame chart. All the local corrections should be used to enter a buy orders as long as the level of 1.2674 is not broken. The long-term target for bulls is seen at the level of 1.4370.

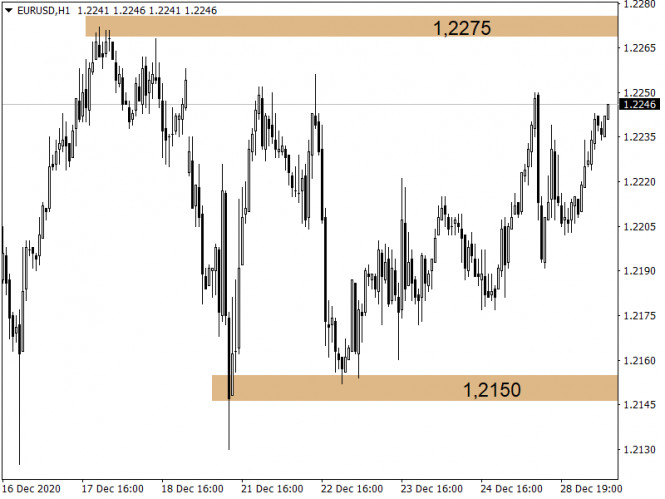

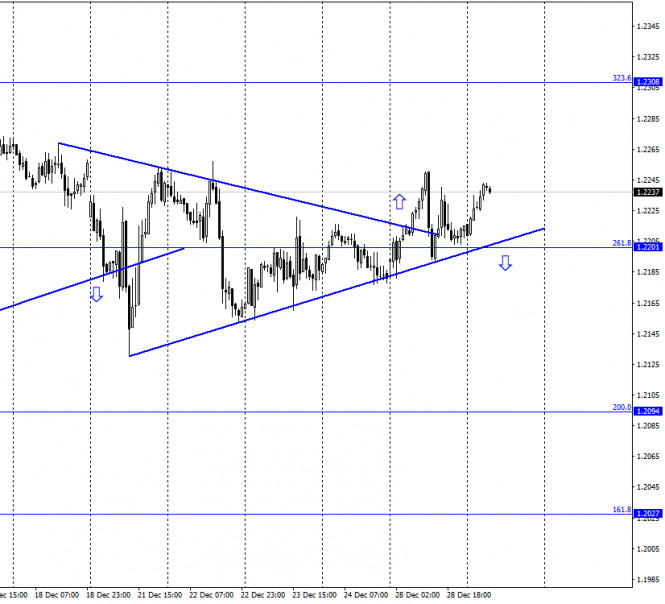

Technical Analysis of EUR/USD for December 29, 2020 2020-12-29 Technical Market Outlook: The EUR/USD pair has bounced from the technical support located level of 1.2154 again and is currently heading higher towards the swing high seen at 1.2272. The Broadening Wedge price pattern is still in progress, so please notice this particular pattern is a trend reversal pattern, which indicates a possible correction on the Euro market soon. For now, the zone located between the levels of 1.2154 - 1.2177 remains the key demand zone for bulls and the zone located between the levels of 1.2250 - 1.2272 is the supply zone. The positive momentum supports the short-term bullish outlook as long as the demand zone is not clearly violated. Weekly Pivot Points: WR3 - 1.2368 WR2 - 1.2314 WR1 - 1.2240 Weekly Pivot - 1.2185 WS1 - 1.2118 WS2 - 1.2062 WS3 - 1.1987 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up. This means any local corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1609. The key long-term technical resistance is seen at the level of 1.2555.

Analytics and trading signals for novice traders. How to trade EUR/USD on December 29? Plan for opening and closing deals on Tuesday 2020-12-29 Hourly chart of the EUR/USD pair

The EUR/USD pair began a new round of upward movement last night. Let's remember that one of the two trend lines - the downward trend - lost its relevance yesterday. But the rising one kept it. Thus, formally, we now have an upward trend and should trade up. A buy signal was created from the MACD indicator last night but it wasn't strong, since the indicator did not have time to discharge to zero. There was no rebound from the trend line either. And so those novice traders who did not sleep at night could have opened new long positions and would be in profit at around 15-20 points. We draw your attention to the moment that along with the trend line, there is also a strong resistance level of 1.2250, from which the pair has already rebounded at least three times in the last week. Thus, it is quite possible that the quotes will rebound off this level again and start moving towards the trend line. In general, we would call everything that is happening now in the foreign exchange market as a kind of flat. Therefore, you need to trade accordingly. No major report or any other event scheduled in America or the EU today, December 29. New Year's week is already in full swing and there isn't really any important information in the markets. Thus, traders can only trade on technique or not trade at all until the end of the New Year holidays. Most of all, the euro/dollar pair is now confused by the fact that the price still does not want to correct in the long term. In fact, the euro has been rising in price since November 2 without interruption. And now would be the ideal time for the pair to fall, but it does not do so. Thus, taking into account this very fact, we can conclude that the upward trend will continue and the euro will keep rising in price in 2021. Moreover, right from the beginning. Well, we just have to identify trends and work them out. Possible scenarios on December 29: 1) Long positions are currently relevant, since the downtrend line has been overcome, and the upward trend has been preserved. At this time, traders may have kept long deals from last night's signal. When the MACD turns down, these trades can be closed. After that, you should wait for the MACD indicator to discharge and create a new buy signal from it, and then consider opening new long positions with targets at 1.2250 and 1.2284. Also, you can consider the price rebound from a trend line as a buy signal. There is also a possibility that the pair will continue to move in different directions. 2) Trading for a fall does not seem appropriate now. In order to be able to re-examine sell orders, you need to get the price to settle below the rising trend line. In this case, short positions can be opened with targets at 1.2181 and 1.2146. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. Analytics and trading signals for novice traders. How to trade GBP/USD on December 29? Plan for opening and closing deals on Tuesday 2020-12-29 Hourly chart of the GBP/USD pair

An upward correction began for the GBP/USD pair last night, as part of a new downward trend that formed yesterday, when the price settled below the upward trend line (now marked with a dotted line). Thus, at this time, novice traders are advised to trade short. Therefore, you need to wait for a new sell signal from MACD. This indicator has already discharged to almost zero level, therefore it can create a relatively strong signal. Let us also recall that the pound/dollar pair rebounded off the 1.3618 level twice, which suggests that even within the "swing", the downward movement will continue for another 150 points. There is no descending trend line or channel at this time, so beginners will have to trade on MACD signals. We also remind you that the New Year's week is in full swing and trading can be much more non-standard than usual. For now, though, the pound is trading in a clear manner (unlike the euro). The macroeconomic calendar for Tuesday does not include any important reports or events. As we said, there won't be any important data during the holiday season. Yesterday it became known that the European Council approved the temporary application of the deal with the UK for a period of two months. This means that before February 28, the European Parliament must now ratify the trade deal with London for it to fully enter into force. In practice, this deal will work in full force from January 1. This is a simple formality. There is little doubt that the European Parliament will ratify the free trade agreement. The same applies to the British Parliament, which must urgently meet tomorrow and also ratify the agreement. Thus, in fact, there are no longer any obstacles in the way of London and Brussels. There are pure formalities left that do not play a special role for the foreign exchange market. This is news from the "something to read" category. They have no effect on the pound's movement. And there is no other news now. And they are unlikely to be this week. Possible scenarios on December 29: 1) Buy orders have lost their relevance, since the price settled below the trend line. Thus, the bulls have released the initiative and now they need to wait for a new upward trend in order to be able to trade up. Such a trend is unlikely to appear the next day. 2) Sell positions are more relevant now. The pair corrected last night and is preparing to fall. Thus, novice traders can only wait for a new sell signal from MACD and open new short positions while aiming for support levels of 1.3392 and 1.3337. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. GBP/USD. December 29. COT Report: Major traders are once again sluggishly buying the pound, however, their "bullish" mood remains very moderate 2020-12-29 GBP/USD – 1H.

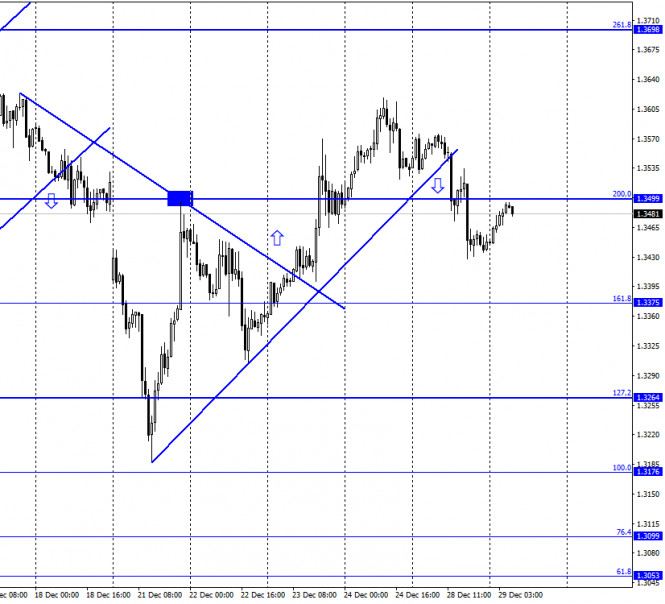

According to the hourly chart, the quotes of the GBP/USD pair on December 28 performed a consolidation under the ascending trend line, so the mood of traders changed to "bearish". After a small pullback up to the corrective level of 200.0% (1.3499), the quotes again performed a reversal in favor of the US currency and resumed the process of falling in the direction of the Fibo level of 161.8% (1.3375). The Briton is not popular among traders this week, however, this does not mean anything at all, since its quotes reached the highs of the year at the very end of last week. Thus, I consider any conclusions that the British pound has started or may start falling now as premature. A vivid confirmation of this is the euro/dollar pair, which also continues to trade near the highs of the year. This suggests that traders are still not looking to buy the US currency. And reasons like Brexit or trade negotiations are only secondary reasons. The dollar index has been falling for several months in a row. The euro and the pound are growing even when the information background is against them. Thus, the conclusion of a trade deal between the EU and the UK helped the British. By and large, traders have already lost all interest in the trade agreement. They are no longer interested in when the European Parliament and the British Parliament will ratify the agreement. However, they should be very interested in the state of the British economy at the end of 2020 and the beginning of 2021, as many experts believe that GDP will still fall in this period. GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and began the process of falling in the direction of the Fibo level of 76.4% (1.3291). In general, starting from November 20, the pair's quotes are moving in a sideways corridor. At first, it was narrow and limited to the levels of 76.4% and 100.0%, then it expanded and is now limited to the levels of 61.8% - 1.3174 and 1.3620. GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). The rebound of the exchange rate from this level will again work in favor of the US currency and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016). GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. Overview of fundamentals: There were no economic reports or other developments in the UK and the US on Monday. The information background was completely absent. The economic calendar for the US and the UK: On December 29, the calendar of economic events in the UK and the US are again empty. The information background will be absent today. COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. The new COT report, which was released only last night, showed only small changes in the mood of large traders. The category of "Non-commercial" traders opened in the reporting week until December 21 - only 2 thousand new long-contracts, and 0.5 thousand short-contracts. Such figures do not allow us to draw any serious conclusions about the future of the British pound. It can be noted that speculators again increased purchases of the British, however, this was already 8 days ago. The total number of long contracts focused on the hands of speculators is only 8 thousand more than short contracts. For example, the difference in the euro currency is 3 times. Thus, I still can not conclude that the mood for the British is exclusively "bullish" and that the pound will continue to grow. GBP/USD forecast and recommendations for traders: It is recommended to open new purchases of the British dollar in case of consolidation above the level of 200.0% (1.3499) on the hourly chart with a target of 1.3620. I recommend selling the pound sterling at a rebound from the level of 1.3499 on the hourly chart with a target of 1.3375. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. Trading recommendations for starters on GBP/USD and EUR/USD for December 29, 2020 2020-12-29 Yesterday's trading was the first one after the Christmas holidays, and not all market participants returned from them. The countries of the British Commonwealth – Great Britain, Canada, Australia and New Zealand celebrated Boxing Day, which means that trade volumes were reduced. The economic calendar was literally empty. Statistics from Europe, the United States or the United Kingdom were not released. What happened on the trading charts? The pound continued its correction against the high of the medium-term upward trend, where the quote found a resistance above it last week, namely in the area of 1.3600/1.3625. The maximum decline of the British currency reached the level of 1.3428, where there was a temporary stop. Moreover, the quote still remains within the side channel 1.2150/1.2275, albeit euro's local upward interest. We expected such a development when the scenario was described in the previous review.

Trading recommendation for GBP/USD on December 29 British traders are here today, but the economic calendar is still empty. The only thing to grasp is the information flow regarding Brexit. We are interested in the comments of high-ranking officials regarding the completed deal. Perhaps, there will be criticism, statements, or something else that can affect speculators' hype. As for price movements, traders are considering the possibility of the pound's further weakening. Sell positions will be considered below the level of 1.3425, with the prospect of moving to 1.3320. An alternative scenario of the market development will be considered if the price is held above the level of 1.3510 in a four-hour time frame, which may lead to a recovery process against the recent correction.

Trading recommendation for EUR/USD on December 29 Similarly in Britain, there was no publication of statistics in Europe. Meanwhile, only the S&P/CaseShiller house price index is to be published in the US, where it is predicted to grow from 6.6% to 6.9%. Traders will continue to move within the amplitude of 1.2150/1.2275, where the method of breaking a particular border is considered to be the best trading tactic. So, moving on a breakdown implies holding the price outside the established limits, preferably for a four-hour TF. This can be followed by a movement towards a breakdown.

EUR/USD. December 29. COT report. US Congress approves Trump's vetoed defense budget 2020-12-29 EUR/USD – 1H.

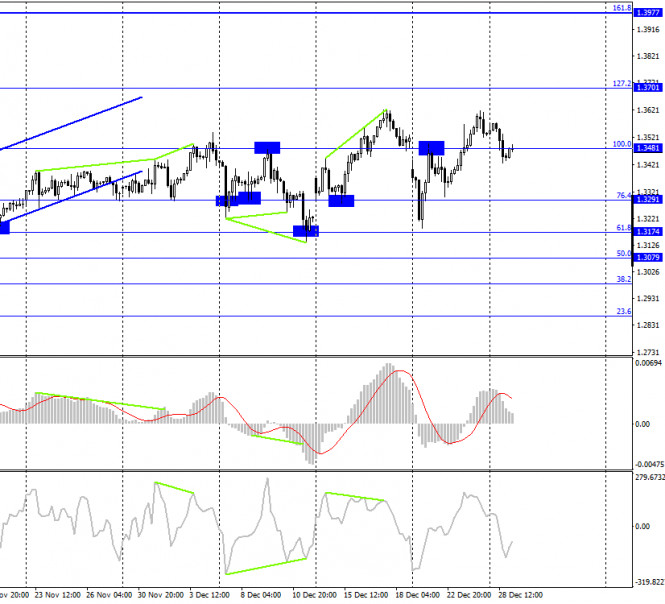

On December 28, the EUR/USD pair performed a new reversal in favor of the European currency near the ascending trend line and began a new growth process in the direction of the corrective level of 323.6% (1.2308). At the same time, the activity of traders in recent days is not too high, and the "bullish" mood is not the strongest. It can be seen that traders are already in a festive state. The pair does not "fly" from side to side - this is good. The movements are calm. And the information background is now practically absent. Perhaps this is partly the reason for the weakness of the trend and the low activity of traders. Nevertheless, a couple of interesting news is still there. First, yesterday, the Lower House of the US Congress voted for a bill that implies an increase in cash payments to Americans under the economic stimulus program from $ 600 to $ 2 thousand. The House of Representatives, which is controlled by Democrats, approved the increase. Now the same bill will have to be approved by senators, where Republicans already dominate. And it was the Republicans who previously opposed any increase in payments to American citizens. Second, the House of Representatives approved the US defense budget for 2021, which was previously vetoed by Donald Trump. The same thing - now the budget must be approved by the Senate, and if it happens, it will be the first time in the entire term of the Trump presidency that his veto will bypass both Houses of Congress. However, this will require the budget to be approved by at least 2/3 of the senators. EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the euro and resumed a slight growth process in the direction of the corrective level of 200.0% (1.2353). The rebound of quotes from this level, which can happen very soon, will allow traders to count on a reversal in favor of the US currency and some fall. Closing the pair's rate under the trend line will also work in favor of the beginning of a fall in quotes. EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair makes a consolidation under the level of 323.6%, there are still high chances of growth. EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term. Overview of fundamentals: On December 28, there was not a single important news or report in the United States and the European Union. There was no information background. Events unfold only in the US Congress, where deputies at the end of the year adopted several important documents and budgets. News calendar for the United States and the European Union: On December 29, there will again be no reports and news in America and the European Union. The information background will be absent today. COT (Commitments of Traders) report:

The latest COT report from December 15 showed a sharp increase in the number of open short contracts by the "Non-commercial" category of traders, which is considered the most important. Before that, speculators had been building up long contracts for four weeks. And now the new COT report, which was released only today, again shows the build-up of long contracts by speculators. This means that they are once again beginning to believe in the European currency, which has only been growing in recent months. The total number of long-contracts focused on the hands of large players is 224 thousand, which is three times more than the number of short-contracts. Since speculators do not currently reduce the number of long contracts and do not increase the number of short ones, I conclude that the euro may grow further. However, let me remind you that each COT report is released three days late, and also describes changes that have already occurred. EUR/USD forecast and recommendations for traders: On Tuesday, I recommend selling the euro if the price is fixed under the upward trend line on the hourly chart with a target of 1.2153. New purchases of the pair can be opened with a target of 1.2256 when the quotes rebound from the ascending trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. Forex forecast 12/29/2020 on EUR/USD, USD/CAD, USD/CHF and USD/JPY from Sebastian Seliga 2020-12-29 Let's take a look at the technical picture of EUR/USD, USD/CHF, USD/JPY and USD/CAD before the Consumer Confidence data from the US are released. GBP/USD and EUR/USD: Bulls are building up long positions at every opportunity. 2020-12-29 News broke yesterday that the European Parliament has approved the Brexit trade deal, however, it was only temporary and its full approval will be considered at the next council session in March 2021. After a brief consultation with the European Commission, the leaders of the EU Parliament said they support the provisional application of the agreement, but at the same time stressed that they, including the European Commission, should study in more detail the proposal to extend the period of application, as such will allow the parliament to more quickly ratify it at the session in March.

But despite this, the British pound is dropping, especially since there are still unsolved problems between the UK and the EU. In particular, central banks, trading floors and fund managers are seriously worried about a rupture in the financial system, because ever since the UK voted to leave the European Union in 2016, little has changed towards building future relationships between their financial industries. In a recent interview, UK Treasury Secretary Rishi Sunak said that negotiations regarding access to financial services will continue after the end of the transition period, and both sides claim that by March 2021, they will seek to sign a memorandum of understanding on cooperation in the field of financial regulation. However, such did not impress banks such as JPMorgan and Goldman Sachs, which, in recent statements, warned about possible relocation to EU cities. In turn, supervisory authorities of the European Central Bank cautioned financial giants over opening offices only by registration, because in order to be able to transfer in the EU, JPMorgan, Goldman Sachs and other financial institutions wishing to leave the UK will have to deal with staff transfers, compliance and operational management directly within the bloc. According to the consulting company EY, about 7,500 workers are currently being relocated. Meanwhile, with regards to the GBP / USD pair, the key level for today is 1.3435, and a breakout from which will lead to a sharp drop towards the 33rd figure, or even to 1.3190. But if the quote consolidates above 1.3530, GBP / USD will move towards 1.3620, and then to 1.3750 In line with this, according to the latest Commitment of Traders report, long non-commercial positions in GBP / USD increased from 35,128 to 37,550, while short non-commercial positions remained practically unchanged and increased only from 31,060 to 31,518. As a result, the non-commercial net position remained positive and grew to 6,032, much higher than its 4,068 figure a week earlier. All this suggests that traders continue to bet on the strengthening of the pound, even in the face of its decline. It seems that the more the currency collapses at the end of this year, the more its demand will increase in the future.

USD: According to the latest data, sales in the US during the holiday season exceeded expectations due to a sharp rise in online sales. A report published by the Mastercard SpendingPulse, which tracks online and in-store retail sales, indicated that total retail sales from the period of October 11 to December 24 rose 3%, while economists had expected growth of only 2.4%. This suggests that consumer demand is constrained not by the desire to resort to accumulation during a possible recession, but by strict quarantine measures, in particular, the closure of many retail stores and outlets, which forced consumers to shop online. The growth in online sales, even amid the problems brought by the coronavirus pandemic, confirms the resilience of the economy. Online sales are up 49% from last year, which suggests that e-commerce now accounts for every $ 5 spent. With regards to the EUR / USD pair, the key level today is 1.2175, and a breakout from which will lead to a reversal and formation of a new downward trend in the market. There is also a chance that traders will close positions at the end of this year, which could push the euro towards 1.2080 and 1.2040 by the end of this week. But if the quote consolidates above 1.2255, EUR / USD could move towards 1.2310 and then to 1.2350. According to the latest Commitment of Traders report, long non-commercial positions in EUR/USD rose from 218,710 to 222,443, while short non-commercial positions jumped from 76,877 to 78,541. The total non-commercial net position rose to 143,902, from 141,833 a week earlier. Since growth has resumed, the euro will most likely rise in the medium term.

Author's today's articles: Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Grigory Sokolov  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Pavel Vlasov  No data No data

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Post a Comment

0Comments