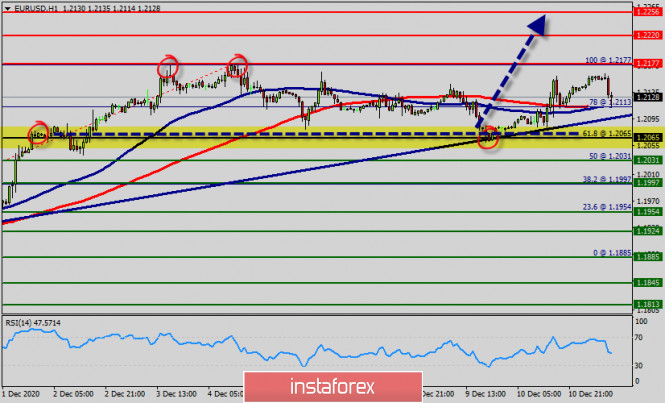

| Technical analysis of EUR/USD for December 11, 2020 2020-12-11  Overview : The EUR/USD pair continues to move in our previous forecast. Right now, the price is in a global uptrend - a channel. It hit its after a push to rise at the level of 1.2065. It rebounds from the support line 1.2065 in order to set at the area of 1.2110. The EUR/USD pair is still bounded in range above the major support of 1.2065 temporary top. Intraday bias remains bullish for the moment. In case of another scaling, upside should be contained by 1.2110 support to bring another rise. A break of 1.2110 resume whole rise from 1.2110, and target 100% of Fibonacci retracement of 1.2177 so as to form double top. An uptrend will start as soon, as the market rises above support level 1.2110, which will be followed by moving up to resistance level 1.2177. Amid the previous events, the price is still moving between the levels of 1.2065 and 1.2177. The daily resistance and support are seen at the levels of 1.2177 and 1.2177 respectively. In consequence, it is recommended to be cautious while placing orders in this spot. Thus, we should wait until the sideways channel has completed. The EUR/USD pair set above strong support at the level of 1.2065, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected for four times confirming uptrend veracity. Hence, major support is seen at the level of 1.2065 because the trend is still showing strength above it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.2110 and further to the level of 1.2177. The level of 1.2177 will act as second resistance and the double top is already set at the point of 0.6747. Accordingly, the pair is still in the uptrend from the area of 1.2065 and 1.2110. The EUR/USD pair is trading in a bullish trend from the last support line of 1.2177 towards the second resistance level at 1.2220. At the same time, if a breakout happens at the support levels of 1.2065 and 1.2031, then this scenario may be invalidated. But in overall, we still prefer the bullish scenario. Downtrend scenario : The downtrend may be expected to continue, while market is trading below resistance level 1.2177, which will be followed by reaching support level 1.2065 and if it keeps on moving down below that level, we may expect the market to reach support level 1.2031 and 1.1997. Forecast : Buy-deals are recommended above 1.2065 with the first target seen at 1.2177. The movement is likely to resume to the point 1.2220 and further to the point 1.2256. On the other hand, if the EUR/USD pair fails to break out through the support level of 1.203; the market will decline further to the level of 1.1997 (daily support 2). Daily key levels - Resistance 3 : 1.2256

- Major resistance : 1.2220

- Minor resistance : 1.2177

- Pivot point : 1.2065

- Minor support : 1.2031

- Major support : 1.1997

- Support 3 : 1.1954

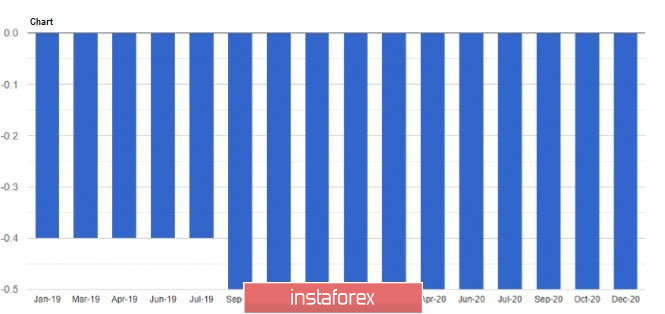

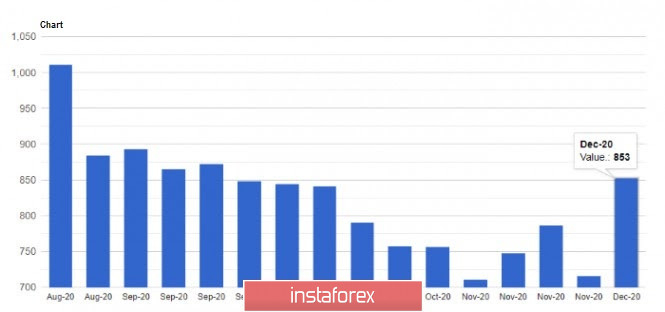

EUR/USD and GBP/USD: Boris Johnson asked business and public to prepare for Brexit without a deal. 2020-12-11 There was no verbal intervention, and the actions of the European Central Bank are very cautious, even despite the strong strengthening of the European currency. There is no doubt that the COVID-19 pandemic remains one of the main risks to the eurozone economy. Therefore, the ECB, together with its President, Christine Lagarde, is working to prevent serious economic problems that have arisen against the backdrop of the pandemic.  In her speech, Christine Lagarde discussed the rate of GDP growth and inflation, and also seriously touched on the exchange rate of the European currency. Many traders, especially those who were betting on the euro's decline, expected sharper statements, given the fact that many European economies are closing amid the second pandemic wave. But since it did not happen, the desire of traders to increase the pound's price began to prevail. Lagarde said the latest data points to a longer period of low inflation, which will remain negative until early 2021. In her summer forecasts, she confidently stated that there are absolutely no deflationary risks, but it turned out quite the opposite. Now, ECB economists are forecasting annual inflation of 1% in 2021 and 1.1% in 2022. Only by 2023 will inflation be able to reach 1.4%. Earlier, the ECB predicted inflation at 1% in 2021 and 1.3% in 2022. The persistence of a low inflation rate will affect the rate of increase in interest rates, on which the exchange rate of the European currency will also depend. As for the outlook of the EU economy, Lagarde expects GDP to contract by 2.2% in the 4th quarter, mainly due to the partial lockdown many EU countries were subject to. But since the long-awaited COVID-19 vaccines offer hope for a solution to the health crisis and a stronger recovery in the coming years, economists forecast the EU GDP to grow by 3.9% in 2021, by 4.2% in 2022 and by 2.1% in 2023. Earlier, the ECB forecasted GDP growth of 5% in 2021 and 3.2% in 2022. At the end of her speech, Lagarde expressed her hope that the EU economic recovery fund will start functioning without delay, as the strengthening of the euro puts downward pressure on prices. As for the adjustment of interest rates, Lagarde only casually mentioned that they are part of the ECB's arsenal, as well as the bond purchase program.  If the euro was able to keep its position amid the recent events, the US dollar was not that lucky. Demand for the currency decreased because of the weakening state of the US labor market. The new restrictions, plus the growing number of COVID-19 cases, threatens another blow to the economy and the labor market, especially since the situation is expected to worsen further. According to some economists, at least 3-4 months will pass before economic activity begins to return to normal. The recent data published by the US Department of Labor said jobless claims for the week of November 29 to December 5 rose by 137,000, totaling around 853,000.  US budget deficit for October also increased, however, this was not surprising given all the financial assistance and borrowing the government was implementing. According to the US Department of Treasury, the deficit between October and November 2020 increased by 25% over the same period the previous year, reaching $ 429 billion. Federal spending rose 9% y / y to $ 887 billion, while revenues were down 3% to $ 457 billion. As for the technical picture of the EUR / USD pair, further upward leaps directly depend on the breakout of 1.2170, as only by that will the euro reach new local levels at 1.2260 and 1.2340. But if the quote drops below 1.2145, the euro will collapse to 1.2060, and then to 1.1980. GBP / USD Yesterday, UK Prime Minister Boris Johnson warned business and the public to prepare for a Brexit without a deal. His meeting with European Commission President Ursula von der Leyen ended without much breakthrough, but Johnson said the UK will still continue to look for a trade deal. He said it was the demands of the EU that are a serious obstacle to the conclusion of an agreement. Meanwhile, it is expected that at the very last moment, German Chancellor Angela Merkel and French President Emmanuel Macron will join the negotiations. Both are now at the EU summit in Brussels and can play an important role as negotiators.  Judging by the market reaction, sentiment and expectations for a trade agreement are rapidly declining. And although both sides are willing to close a deal, no one is willing to make significant concessions. Yesterday, the European Commission proposed measures in case the UK and the EU fail to conclude an agreement. These measures include a fisheries agreement for a period of one year, as well as the extension of the current rules of interaction and safety in air transport. These proposals, however, did not provoke any reaction from the UK. More than four years have passed since the UK voted to leave the EU. This year, the parties hoped that they would be able to settle all differences, but this did not happen. Most likely, on January 1, the UK will return to the general rules of the World Trade Organization and further trade relations with the EU will be conducted according to common tariffs and quotas. As for the technical picture of the GBP/USD pair, the breakout of 1.3245 will lead to increased pressure on the British pound, as well as to its immediate decline to 1.3190, 1.3115 and 1.3030. The upward trend will only resume if the quote breaks above 1.3490. But until that moment, the bulls will have to somehow cope with the levels of 1.3340 and 1.3390. Trading plan for the EUR/USD pair on December 11. Increased COVID-19 infections in US and Germany. 2020-12-11

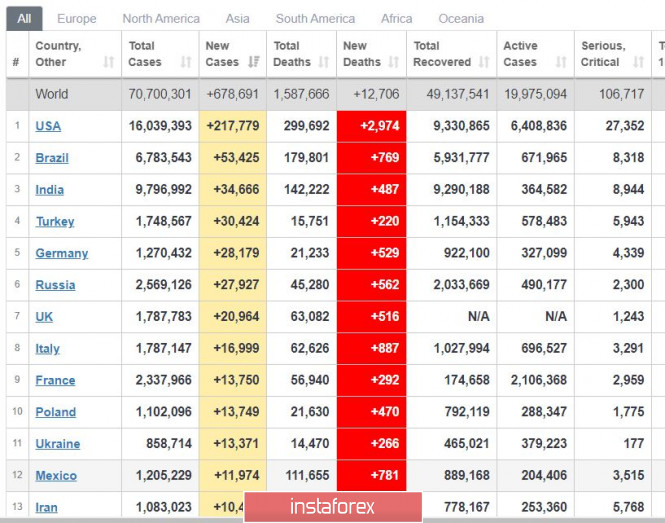

Yesterday, global COVID-19 incidence increased again, reaching 678,000, just 2,000 short of its peak of 680,000. Most of these cases came from the United States, which recorded a growth of 200,000 new infections. Deaths, meanwhile, amounted to 3,000 yesterday. The situation is also bad in Germany. But in other European countries, a strong decline in the figures were observed. This suggests that the strict quarantine measures implemented by authorities were very effective. As for the UK, mass vaccination begins today.

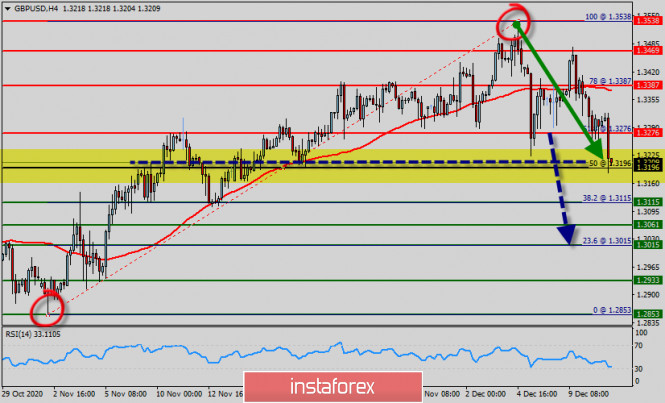

EUR / USD - Demand for the euro is growing after the ECB announced its decision to expand support for the economy by € 500 billion (up to $ 1.8 billion). But so far, it is facing strong resistance around 1.2200. Open long positions from 1.2165. Open short positions from 1.2058. Technical analysis of GBP/USD for December 11, 2020 2020-12-11  Forecast : - Our preference below the price of 1.3276 look for further downside with 1.3115 and 1.3061 as targets. The RSI is bearish and calls for further decline.

- Alternative scenario : long positions below the level of 1.3276 with targets at 1.3387 and 1.3469 in extension.

Overview : The GBP/USD continues its attempts to settle below the nearest support level at 1.3196. The price is still trading around the zone of 1.3276 - 1.3196. The GBP/USD pair has broken support at the level of 1.3276 which acts as a resistance now. According to the previous events, the EUR/USD pair is still moving between the levels of 1.3276 and 1.3196. Therefore, we expect a range of 80 pips in coming minutes at least. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Hence, the price area of 1.3276 remains a significant resistance zone. Consequently, there is a possibility that the GBP/USD pair will move downside. The structure of a fall does not look corrective. In order to indicate a bearish opportunity below 1.3276, sell below 1.3276 with the first target at 1.3115. Besides, the weekly support 1 is seen at the level of 1.3115. From this point, we expect the GBP/USD pair to continue moving in the bearish trend from the support level of 1.3115 towards the target level of 1.3061. If the pair succeeds in passing through the level of 1.3061, the market will indicate the bearish opportunity belw the level of 1.3061 so as to reach the third target at 1.3015. The price will fall into a bearish trend with a view to go further towards the strong support at 1.2933 to test it again. The level of 1.2933 will form a double bottom. However, the daily strong resistance is seen at 1.3276. If the GBP/USD pair is able to break out the level of 1.3303, the market will decline further to 1.3469 (daily resistance 2). Since the trend is below the 61.8% Fibonacci level (1.3276), the market is still in a downtrend. Overall, we still prefer the bearish scenario. Trading recommendations for the EUR/USD and GBP/USD pairs on December 11 2020-12-11 EUR / USD during yesterday's trading session: Demand for the euro increased yesterday, as a result of which the quotes returned to the area of the conditional high. What was published on the economic calendar? The European Central Bank (ECB) held a meeting, during which the base interest rate on loans was left at zero. At the same time, the regulator took a big step towards injecting even more money into the economy, and they did this by expanding the bond purchase program by another € 500 billion euros. Now, the volume of the program amounts to € 1.85 trillion. On the one hand, it may seem that this step will stimulate the economy, but on the other hand, it is a quantitative easing program that negatively affects the value of the national currency in the medium term. What happened on the trading chart? From the start of the European session, the market was dominated by upward interest, where, to everyone's surprise, the ECB meeting played in favor of the euro's strengthening, which is not entirely logical in terms of the regulator's decision and market reaction. Many assume that it was the high degree of speculative activity that led to the irrational price change in the market. GBP / USD during yesterday's trading session: The pound continued its decline, but it did not manage to overcome the local low. What was published on the economic calendar? Data on UK's industrial production was published, where, instead of the expected slowdown, there was an acceleration of 1.7%. This suggests that the rate of decline is slowed from -6.3% to -5.5%, against the forecast of -6.5%. The indicators are good, but they were of little interest to the market, especially since speculators are working on fears of a Brexit without a deal. To add to that, in the afternoon, weekly data on US jobless claims was released, and its figures came out worse than expected. The Economists expected the volume of reapplications to decrease by 185,000, but instead, there was an increase of 230,000. Initial applications, meanwhile, were supposed to increase by 13,000, but instead, the increase to 137,000, which is quite a lot. This divergence in expectations played negatively on the dollar's positions, thereby stopping the depreciation of the pound against the dollar. What happened on the trading chart? Initially, the pound felt a lot of pressure from sellers, as a result of which the rate fell to 1.3245. After that, there was a stop with a slight pullback towards the previously passed level of 1.3300. The negative statistics from the United States only locally supported the British pound, and is considered a temporary phenomenon in the market.

Trading recommendation for the EUR / USD pair Today, data on US PPI will be published, and many expect it to show an increase from 0.5% to 0.8%, which will positively affect the US dollar. In terms of technical analysis, it is clear that the area of 1.2160 / 1.2177 negatively affects the volume of positions on the euro, especially since the currency is highly overbought at the moment. Thus, it can be assumed that the quote will try to correct in the direction of 1.2100-1.2080.

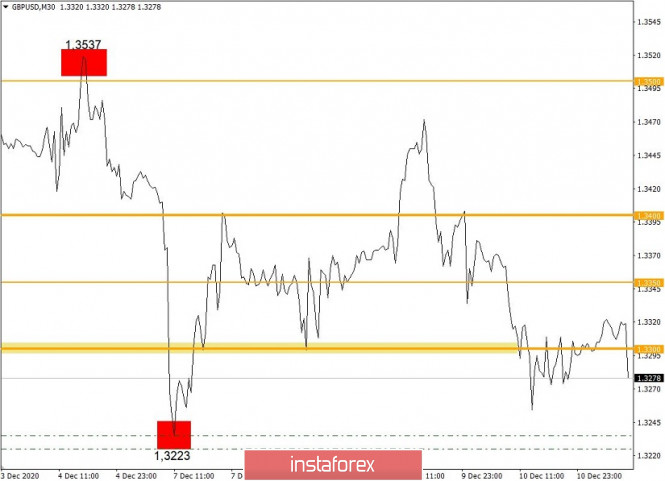

Trade recommendation for the GBP / USD pair There is only statistical data from the United States today, but news on Brexit, as before, will persist in the market and may negatively affect the exchange rate of the British pound. In terms of technical analysis, price jumped down sharply during the European session. If it remains below 1.3300, the pound will collapse even further to 1.3223.

EUR/USD analysis for December 11 2020 - Upside continuation is on the way towards 1.2160 2020-12-11 EU's von der Leyen: Brexit positions remain far apart on fundamental issues European Commission president, Ursula von der Leyen, briefs the press Fairness is key on level playing field - This is not to say we'd require UK to follow us every time we raise standards

- UK would remain free to decide

- Have not bridged differences on fisheries

- We decide on Sunday whether we have conditions for a deal or not

She concludes by saying that "in three weeks, it will be new beginnings for old friends" in a nod to the end of the Brexit transition period on 31 December. Or so, that is supposedly the "deadline" for now. As much as there is the risk where they might reach a decision for a no-deal outcome this weekend, one can't help but wonder that surely they will still find some reason to head back to the negotiating table before 31 December. Further Development

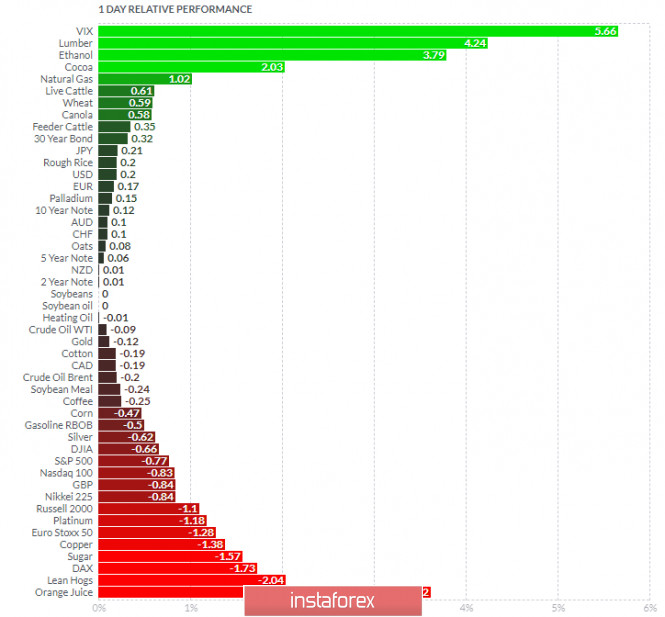

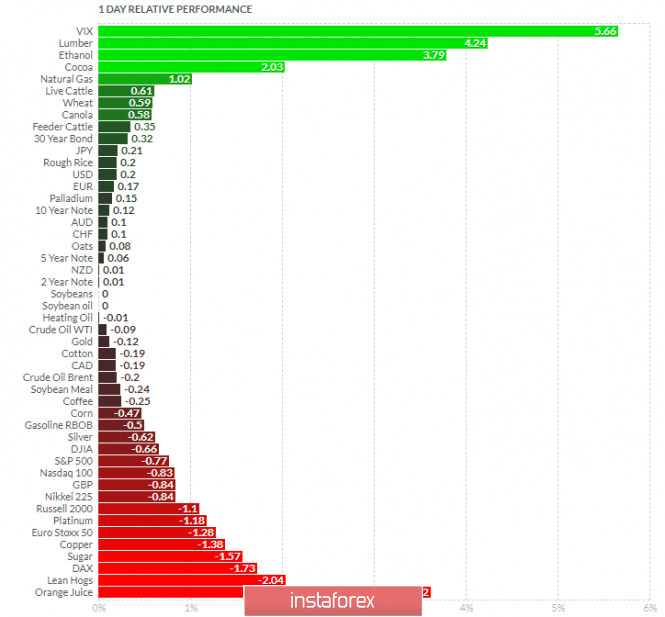

Analyzing the current trading chart of EUR, I found that the sellers got exhausted today and that there is the breakout of downside trend channel that happened yesterday, which is good sign for further rise. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Lumber today and on the bottom Lean Hogs and Orange Juice. Key Levels: Resistance: 1,2170 Support level: 1,2095 Analysis of Gold for December 11,.2020 - Watch for buying opportuntiies with the target at $1.874 2020-12-11 UK PM Johnson: It is looking very, very likely we will have a no-deal Brexit Comments by UK prime minister, Boris Johnson - Fisheries is a big problem

- There is a way to go

- Yet to see a big change from the EU

Essentially, the dinner meeting between Johnson and von der Leyen resulted in both sides now threatening that they are fine with letting the clock tick down and a no-deal outcome will kick into effect as such. That might be how things transpire on Sunday but don't rule out a return to the negotiating table before 31 December.

Further Development

Analyzing the current trading chart of Gold, I found that the sellers got exhausted today and that there is potential for the upside reaction and upside trend to resume. Watch for buying opportunities with the targets at $1,874 and $1,896 Stochastic oscillator is showing oversold condition, which is good indication for further rise.... 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Lumber today and on the bottom Lean Hogs and Orange Juice. Key Levels: Resistance:$1,850 and $1,874 Support level: $1,824

Author's today's articles: Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Pavel Vlasov  No data No data Mihail Makarov  - - Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Post a Comment

0Comments